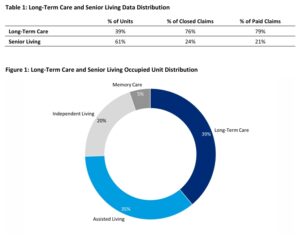

Marsh (largest insurance broker in the world) recently released its 2024 General and Professional Liability Report 2024-General-Professional-Liability-Benchmark-Report-MAR-USA. The report includes data from fifty senior living and long-term care providers comprising 10,300 closed claims with paid indemnity and expense value of $1.87 billion across a ten-year horizon. The ten-year data was used by Marsh to forecast claims outcomes for 2024.

As readers/followers know, my firm H2 Healthcare, LLC maintains a very busy and focused practice area in compliance and litigation support. Our work spans multiple law firms and insurers, providing support and analysis for senior living and post-acute care claims in matters alleging substandard care and wrongful death.

In terms of risk, falls continue to be the largest source of claims, generating almost 50% of the claims paid by long-term care facilities and greater than 70% at senior living facilities (primarily Assisted Living) over the past 10 years. In long-term care facilities, there were 1,840 fall-related claims for residents that closed, amounting to an estimated total loss of $448.8 million. Wounds and skin injuries ranked second, with 773 claims closed and an estimated total cost exceeding $220 million. Infections followed, with 461 claims resulting in a total cost of $153.1 million.

The above data parallels our experience in our practice. Falls remain the number one case (volume) type we review/support followed by wounds and then, all others. What we notice, as does Marsh, is the increase in wound cases emanating from senior living facilities, namely Assisted Living.

Two factors are at play. First, Assisted Living units are in surplus supply in many regions thus, causing providers to admit a more advanced care level resident (more advanced clinically, requiring more skilled services). Second, many providers that do admit a more advanced care level resident don’t have sufficient on-staff, on-site resources to manage the higher acuity. The result is often a reliance on other providers such as home health agencies to deliver the skilled services. When care coordination breaks down among providers, negative outcomes are common.

Wound complications that beget litigation are complex cases, typically with greater layered liability than a fall case. If the outcome is death, the questions are around risk mitigation that was employed to prevent the wound or, if the resident was admitted with the wound or history of skin risk, how the wound was managed. Typical wound cases involve residents with deep comorbidity histories (diabetes being a primary comorbidity).

Per Marsh, Kentucky, Florida, and California experienced the highest loss rates among states for long-term care providers. Similarly, Florida, California, and Illinois were the states with the highest loss rates for senior living providers, according to the report.

Although the final figures for 2024 are not yet released, the report forecasts a 0.3% rise in the frequency of claims and a 3.7% hike in the severity of claims for long-term care facilities. Additionally, these facilities are anticipated to experience a 4% growth in their loss rates for the year.

The data presented in terms of claims in the Marsh report excludes claims related to COVID. Marsh does provide some background however, on COVID claims. At present, approximately 95% of claims classified as COVID-19 have been closed. These claims were recognized as COVID-19 through either a specific indicator for the pandemic or via details provided in the claim’s description. Around 85% of all COVID-19 related claims were filed in 2020. Since then, there has been a consistent decrease in the volume of claims stemming from the pandemic.

Per Marsh, the majority of all COVID-19 claims close without payment and this percentage has remained at 95% or greater since the start of the pandemic. This is principally due to various state and federal laws passed during the public health emergency, limiting liability for COVID infection arising from healthcare providers (including long-term care and senior living). More on COVID liability is available here: https://rhislop3.com/2023/10/13/friday-feature-sr-living-health-care-and-covid-litigation/

What the Marsh report doesn’t cover is prevention and risk management. I’ll cover more on this topic in an upcoming post but for now, a prior post on liability, litigation, and risk management that I wrote may be of interest. https://rhislop3.com/2024/06/11/defend-your-long-term-care-facility-against-litigation-with-expert-data-analysis/

For additional information on Marsh and additional reports, go to Marsh | Global Leader in Insurance Broking and Risk Management