The healthcare sector has experienced another quarter of record-high distress levels, as indicated by the volume of bankruptcy filings, with the senior living and care sector at the forefront. This bankruptcy trend for senior living remains alarming. In January, I took a look at 2023 bankruptcy levels, the worse year in decades. That post is here: https://rhislop3.com/2024/01/29/record-bankruptcies-in-health-care-in-2023/

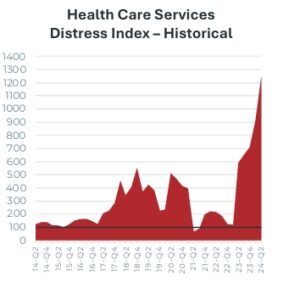

According to the Second Quarter 2024 Chapter 11, Healthcare and Real Estate Report via Polsinelli-TrBK Distress Indices (2nd Quarter 2024 Chapter 11, Healthcare, and Real Estate Distress Indices: DistressIndex.com) the Health Care Index has recorded the highest distress level in the report’s history for the fifth consecutive quarter. The data indicate that the present level of Chapter 11 filings is nearly 50% higher than the healthcare distress levels during the peak of the Great Recession in 2008-2009.

For the second quarter of 2024, the Health Care Services Distress Research Index stood at 1241.67, marking an increase of over 328 points from the previous quarter. When compared to the same period a year ago, the Index has risen by more than 653 points, and it has surged over 1141 points since the benchmark period in the fourth quarter of 2010. This current level is the highest recorded by the Health Care Index since its inception 13 years ago, surpassing the peak values of the preceding four quarters.

The Chapter 11 Distress Research Index was noted at 91.87 for the second quarter of 2024. Meanwhile, the Real Estate Distress Research Index reached 53.91 for the same period, climbing over 6 points since the last quarter.

In senior living and care environments, including independent living, assisted living, memory care, continuing care retirement communities, and nursing and skilled nursing facilities, Chapter 11 bankruptcy filings have accounted for about half of the distress in the healthcare sector over the past few years.

CCRCs, single site and smaller multi-property owners, are struggling more in many regards than single segment properties (Assisted Living, Independent Living, etc.). They carry more debt, particularly non-profits (bulk of industry provider type), with bond facilities that are disproportionately large compared to the value and cash flow produced by the underlying property. If the debt is variable or swapped, interest rate fluctuations have created increased servicing pressures. Credit enhanced debt may see term changes that call for increased equity infusion and/or, additional interest service. Labor costs also remain a significant challenge, now 30% to 40% higher than pre-pandemic levels.

Another concern across the industry for CCRCs is revenue-risk concentration. Rate increases during and immediately post-pandemic were steep and for the most part, absorbed by the residents. Above inflation increases however, are less acceptable as other resident living costs have increased. There simply is less room for above fixed income parity, increases (more than social security increases).

The risk concentration is that most CCRCs rely almost exclusively on occupied unit rents or fees, and for entry fee communities, entrance fee turnover. As expenses rise, and occupancies remain challenged below 90% for many communities, revenue constrained to unit-based fees may not be sufficient to cover rising costs. For years, I have preached to the CCRC industry that revenue diversification is critical to ongoing stability and growth opportunities.

Revenue diversification strategies encompass a number of options such as home care and home health. I like this one especially as CCRC residents desiring to age more in-place, often access support services. A community or communities that offer Medicare and non-Medicare services can add significant revenue, share existing infrastructure (space, staff to a certain degree, billing, human resources, etc.), spreading and leveraging overhead. Hospice can work the same. Further, these same services can be offered to the community at-large, building marketing connections and referral opportunities, along with partnerships via other free-standing housing communities (providing services to residents therein). Bottom-line: The additional revenue from these services eases rate pressure and provides a buffer for softer occupancy periods.

Providers wary of distress should approach expansion cautiously, as it can quickly become overwhelming if the figures don’t align with the consultants’ projections. Internal program expansion such as adding home health is far less risky (typically, no need to borrow funds to do so and there is minimal if any, overhead required) than adding new care locations or expanding community capacity via taking on debt. There is a general need to expand and grow, and it’s how to make more money, but that may not be true if the growth is not properly coordinated with market dynamics and economic conditions. Leveraged growth right now, in a high cost/tight conditions capital environment, is unadvisable (my opinion).

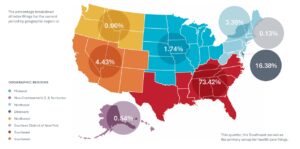

Overall distress in senior living is a national problem but property location is more concentrated in the south/southeast.

Bankruptcies in senior care, along with those in the pharmaceutical sector, accounted for nearly half of all Chapter 11 filings in healthcare during the last three quarters. The healthcare industry is still grappling with significant financial challenges, such as inflation, labor shortages and rising costs, heightened regulatory expenses, and reimbursements that fail to match cost increases. While some sectors are under severe strain, certain organizations are more adept at handling these challenges, often due to lower debt levels and diversified revenue streams.