Among the many challenges providers have faced economically, higher borrowing rates (interest) has remained in the top three. For senior living, higher capital costs and tighter borrowing conditions (LTV, more restrictive covenants, etc.) have all but slowed new development to a halt.

Higher borrowing rates are at the bank level, a function of Federal Reserve rates, namely interbank rates aka the “fed funds” rate, have persisted across the last twenty plus months. Yesterday, the Federal Reserve cut this key rate (Fed Funds) by .50% or half of a point, down from the range of 5.00 to 5.25 to 4.50 to 5.00. Federal Reserve Board – Federal Reserve issues FOMC statement

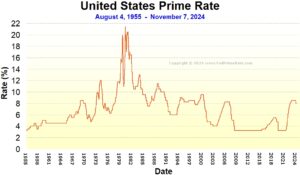

Fed policy is typically influential on a lagging basis. Other factors apply to loan rates such as the risk of the credit or in other words, the strength of the buyer to repay the loan. Weaker credits/borrowers receive rates that are degrees or “points” higher than the strongest, most credit worthy borrowers. For years, the standard rate for the best commercial borrowers at the bank credit windows was known as Prime. The Prime rate today dropped to 8%, down from 8.5% where it was since July 27, 2023. Not by coincidence, this was the day after the last Fed Funds rate hike to 5.00 – 5.25 (July 26, 2023)

Today, the Prime rate is less applicable in terms of bank/commercial lending. For providers seeking large amount of funds via borrowing, the capital markets (bond market) are more efficient. Non-profits seeking millions of dollars can almost always, if their credit profile is strong, access funds at lower interest costs than via bank loans. Below is an example of some commercial bank loan rates available today (note, these rates would be typical but not exact as the customer’s credit would dictate final rate). Note: CMBS stands for Commercial Mortgage-Backed Security.

Bond rates or capital market lending rates are a function of comparable securities and most common, the ten-year Treasury. The Treasury security is the gold standard so to speak, so bond rates, especially non-profit bonds, occur in parallel to the Treasury security, with a spread. A non-profit or municipal borrower today that is AAA rated (the highest credit worthy level) would pay just a shade below the ten-year Treasury yield (3.6%). The difference is the tax effect (non-profit, municipal credit is non-federally taxed and could be in some cases, double tax-exempt (state/local tax)).

So, back to the title of this piece. Will the Fed rate cut help providers in terms of improved credit access? The answer: yes, but not immediately and not significantly. Rate is but a tiny element within a credit transaction and as mentioned earlier, not always at an equal footing to index rates. In other words, the credit conditions of the borrower and the nature of the loan (collateral for example), have more to do with final rate (borrowing rate) realized than the Fed Funds Rate or the bank’s Prime rate, etc. In time, and with continued cuts, borrowing rates will trend down to perhaps, more palatable levels.

The realization of a return to pre-pandemic level credit markets and bank lending access is still mired in some economic “gook” (technical term for funk). Consider the following current credit market and bank lending conditions. These have as much of a, if not greater, impact on credit and borrowing as rate.

- For smaller to medium size providers ($200 million and under), regional banks and local banks are the dominant sources of commercial credit. Depending on their commercial holdings to date, many banks are leery to take on too many additional commercial real estate loans. They are already perhaps, facing the prospect of significant portfolio losses. This means, the sources for credit, regardless of rate, will remain limited.

- Healthcare is an interesting sector in so much that it is broad and spans many, many sub-businesses. Lenders may favor some types of healthcare credit while shunning others. Senior living for example, is considered a decent credit from the perspective of demand for services but other underwriting challenges such as reimbursement risk, labor risk, regulatory oversight risk, influences credit decisions. Again, these conditions have nothing to do with “rate” decisions by the Federal Reserve.

- Capital market credit decisions are a function of money flows – demand in and out. The bond market, especially the non-profit public finance side for healthcare credit, has been slow. Two reasons: buyers have found other investments with better return options for lower or parallel risks (short-term treasuries are very attractive) and second, borrowing conditions including terms have been not-so-favorable as of late. Treasury yields have been high, influencing the rate conditions in the credit markets.

Stay tuned as there will be more to come on this subject and I will provide additional updates, economic and credit, as conditions warrant. Some additional reading on this subject is available from a post I did late last year https://rhislop3.com/2023/11/17/friday-feature-senior-living-credit-borrowing-still-very-soft/