No other segment of senior living/senior care got rocked as much by the pandemic as skilled nursing. Frankly, the industry had challenges from labor shortages and lagging reimbursement entering the pandemic (2020). The pandemic didn’t just accentuate these issues, it blew them up in terms of magnitude (impact) while adding supply chain issues, inflation, and increased (dramatically) capital costs.

Suffice to say, recovery has been slow and, in some cases, still hasn’t settled in. Labor challenges remain the sector’s single greatest negative headwind as costs are up due to labor shortages (raise wages to attract and retain labor) and the need for continued reliance on agency staff to fill shifts/ add hours. And, as if to complicate the issue even more, on Friday, the Biden Administration, dropped a proposed rule for a staffing mandate (hours per resident/patient day). See my post from Friday, inclusive of the proposed rule here: https://wp.me/ptUlY-Mx

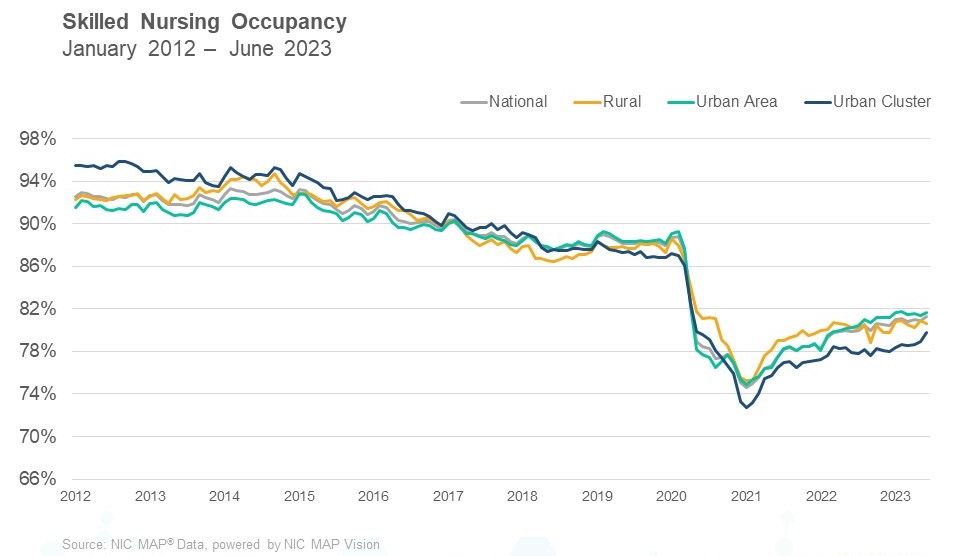

The modicum of good news on the sector came from NIC (National Investment Center) indicating, via their data, that SNF occupancy rates reached their highest 2023 point in June – 81.7%. The low point (recent) was 74.6% in January 0f 2021 (full pandemic effect). Pre- pandemic (Feb 2020) occupancy was 88.8%. SNF occupancy was on a decline up to the pandemic and as visible via the graphic below, took a steep drop during the pandemic.

Occupancy gains will continue to be directly correlated to staffing levels/staff availability. Most providers that I follow don’t struggle for referral volume. Their occupancy level is a function of staff availability in numbers and competency to accept referrals. For example, a higher case-mix (more acute) requires more skilled staff (RNs, PTs, OTs, etc.). The more complex the referral, the greater the need on the part of the SNF to not only have sufficient numbers of staff but sufficient levels of skilled staff such as RNs. Today, the scarcest and most expensive resource (staff) for an SNF is an RN, employed or agency.

Shifts in payer mix are a function of two elements. First, ability of the SNF to accept referrals, particularly skilled-mix (Medicare) referrals. Second, competition from other providers, namely home health (direct to home referrals) and rehab hospitals (IRFs). To a certain extent, these three provider types (SNF, HHA, IRF) compete for the same patients. Additional payer mix data is below, courtesy of NIC.

- Medicare revenue mix declined as the revenue per patient day increased slightly in June. Both remain down from December 2022. Medicare revenue mix is down from the most recent in high in February 2022. This was a time when increased cases of COVID-19 resulted in additional utilization of the 3-Day rule waiver combined with higher, per day reimbursement for COVID patients. With the end of the COVID Public Health Emergency, the three day/three overnight waiver ended. Medicare revenue mix ended June at 18.0%. Managed Medicare revenue mix was up 61 basis points to 12.0% in June.

- Managed Medicare revenue per patient day increased in June, but it is down 0.5% from last June 2022. For most SNFs that focus on post-acute care, the decline in managed Medicare revenue per patient day can pose a challenge as the reimbursement differential between Medicare fee-for-service and managed Medicare continues to increase. Some SNFs see a chance to capture patient volume with the growth of managed care. Medicare fee-for-service revenue per day ended June 2023 at $590 and managed Medicare ended at $490, a difference of $100 per day.

- Medicaid patient days continued their upward trend in June, ending at 66.7%. Medicaid reached the pandemic low of 63.2% set in February 2022. Meanwhile, Medicaid revenue mix increased 130 basis points from the prior month, ending June at 52.7%. Most SNFs still rely heavily on other payers such as Medicare, Medicare Advantage, private pay, etc., to offset Medicaid losses – reimbursement levels below the actual cost of care.