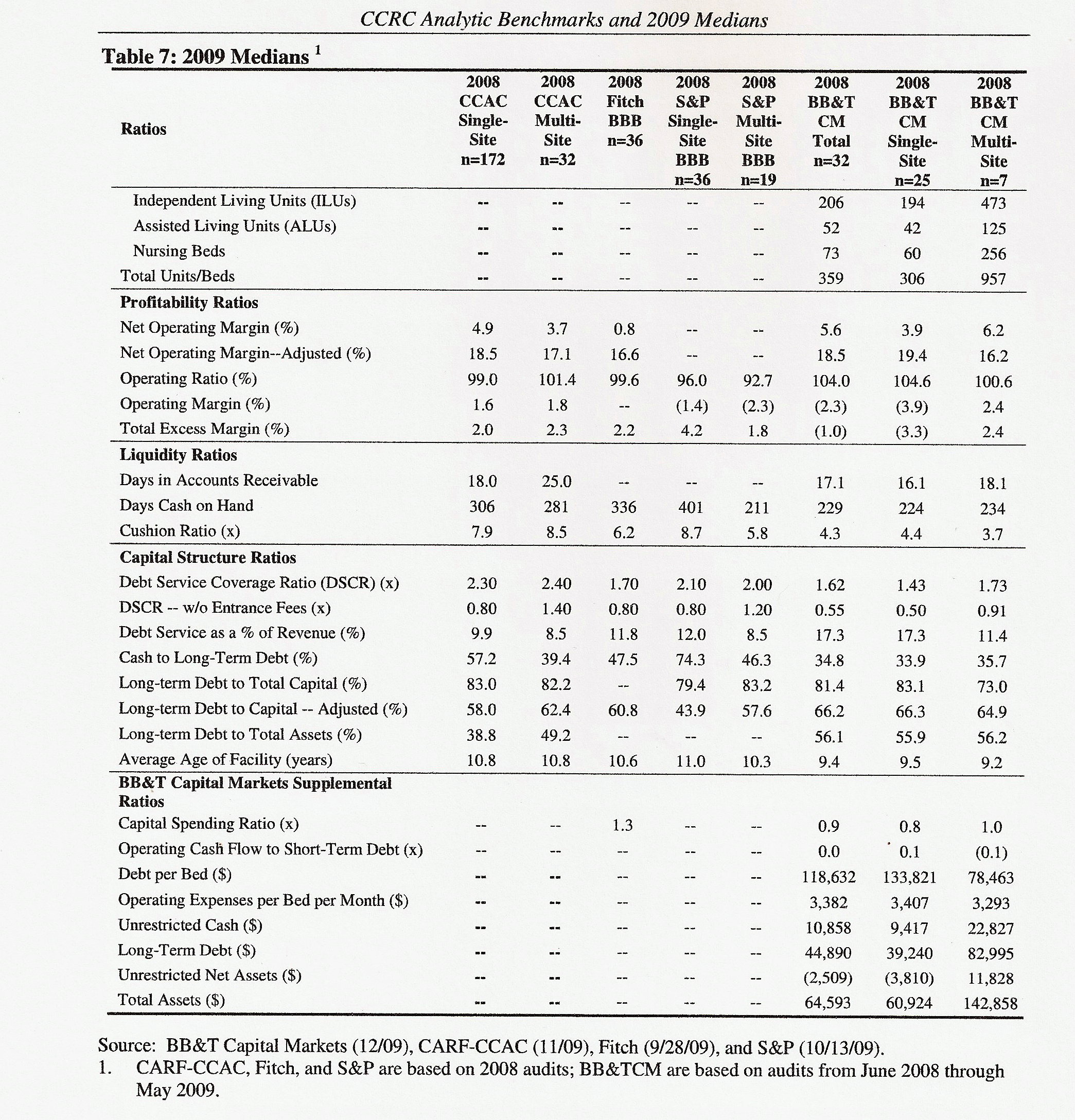

Within the past ten or so days, I took some time to review the financial and operating benchmarks for CCRCs. The past eighteen months have likely been the toughest operational and financial period ever for CCRCs. By the end of 2009, a small rebound in the economy via an increase in existing home sales, a solid financial markets recovery, and a bit of moderation in the capital markets improved the industry outlook heading into 2010. Specifically, the lagging trends in occupancy stabilized and improved ever-so gently and key operating and capital ratios started to stabilize. The result is that while key medians and benchmarks slid year-over-year (between 08 and 09), 2010 could be rebound year for the industry. Below, I have included a chart of the 2009 CCRC medians as produced by each major rating agency (chart courtesy of BB & T Capital Markets, a division of Scott & Stringfellow, Inc.).

Where continued issues of concern remain are principally in newer, non-stabilized developments, CCRCs located in extremely depressed real-estate markets and CCRCs that are subject to having to refinance favorable debt packages within today’s lending environment (expiring Letters of Credit, etc.). Concerns that were present in early 2009 regarding entry fee CCRCs seem to have moderated as the improved real-estate market has made it possible for prospective residents to either move via selling their homes or be in a positive position to sell their homes in the near future. Again, individual market dynamics play a major factor in how the upcoming months shake-out for new entry-fee CCRC sales.

An area of continued concern for CCRCs is the capital markets and the ability of owners/operators to access new debt at favorable terms. Failures, albeit few in the industry, have made lenders cautious and today, rates and terms reflect the caution as well as the year-over-year decline in the industry benchmarks. Fitch as well as other rating agencies has not yet fully warmed to the prospects of recovery for the industry as a whole and as such, continue to produce negative to bland outlooks for the industry. Essentially, the story here is twofold: First, the upcoming year will remain a fairly down year for development as capital for new projects will not be plentiful and not at favorable terms, and; second, refinancing existing debt for solid operators with stabilized projects will be possible and increasingly so as the year progresses, though not yet at terms and rates that are better than the periods prior to 2008.

Looking at 2009 and ahead into 2010, a few key items for CCRC owners/operators to review are as follows.

- Sales always lag marketing efforts and as a result, CCRCs that have stuck to their marketing plans and stayed engaged with prospective residents will reap the rebound “rewards”. Any CCRC that has pulled too far back on continued marketing needs to get busy now to improve their 2010 prospects.

- Entry fee CCRCs need to be continuously vigilant regarding their pricing and the economic conditions of their market place. Entry fee CCRCs have the most elastic demand curve and price positioning is key to staying forefront in the senior’s demand cycle for retirement housing options.

- When and if the GAO produces its report on CCRCs, the principal focus will be on disclosure and customer knowledge. In effect, the key “take-away” here is this process is all about consumer protection. Aside from making sure the finances are solid, CCRC owners/operators need to beef up their consumer disclosures, their education efforts and clean-up their contracts and marketing materials.

- The four key benchmarks, aside from occupancy, that a CCRC needs to focus on for 2010 are: Net Operating Margin, Excess Margin, Days Cash on Hand, and Debt per Unit or Bed. If a CCRC is considering accessing the capital markets or borrowing from any lending source, moving these indicators up or down as appropriate to rank better than the median will improve the terms and rate available to your project.

- Soft and recovering markets call for strategic pricing evaluation and strategy. It is important to continue to increase revenues but doing so simply through rate increases may not be the best approach. Rate increases are one component of an overall pricing strategy. If a CCRC has not done a complete review of its competitive posture, its pricing structure and especially, its value proposition correlated to price, it should consider doing so immediately.