On Monday, January 20, Donald Trump will be inaugurated as the 47th president of the U.S. While his claim of an election mandate is very debatable, the expectations that come with his return to office are many. Chief among these expectations is that he/his administration will “fix” the debt driven, inflation riddled economy of the last four years.

A significant driver of federal spending, in fact, other than Social Security, is healthcare spending. The U.S. spends more by any measure on healthcare (per capita, total) than any other world nation. Our healthcare total spend exceeds the total GDP of nearly every other country in the world (we spend more on healthcare than the total GDP of Canada for example). The issues around healthcare spending are not new. In 2012 I wrote a post about healthcare spending and the U.S. budget debate at the time. Readers would note the similarities to then vs. now. https://rhislop3.com/healthcare-and-the-fiscal-cliff/

During his campaign, candidate Trump, like most politicians running for office, pledged that he would not cut Medicare. What we know is that Medicare without some (significant) measure of reform stands to be insolvent, if current projections hold, in 2036. https://rhislop3.com/issue-medicare-solvency/

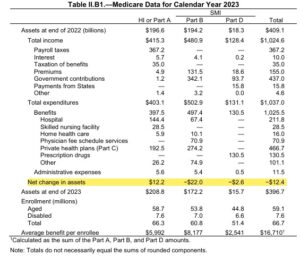

Total Part A spending is projected to exceed revenues beginning in 2030, which means Medicare Trust Fund reserves will be needed to pay benefits. By 2036, there will be insufficient revenues, including reserves, to pay full benefits for the year. Medicare would be able to pay 89% of costs covered under Part A using payroll tax revenues in that year. The leading cause of this financial shift is demographic. The support ratio of working taxpayers (Medicare wage tax) has dropped below the support level for seniors receiving Medicare benefits.

The revenues for Medicare Parts B and D are determined annually to meet expected spending obligations for the coming year, meaning that the Supplementary Medical Insurance, or SMI, trust fund does not face a funding shortfall. Higher projected spending on Part B and Part D (drugs primarily) will increase the amount of general revenues (tax revenue or today, increased debt) and beneficiary premiums required to cover this spending. Beneficiary premiums and cost sharing for Part B and Part D will account for 26% of the average Social Security benefit in 2024.

Medicare Advantage enrollment today represents 50% of all Medicare participants and growing. In 2024, MedPAC estimates that the Medicare program will spend 22% more per Medicare Advantage enrollee than for cohort beneficiaries in traditional Medicare – an additional $83 billion in total. June 2024 Report to the Congress: Medicare and the Health Care Delivery System – MedPAC

Just in terms of Medicare, the Medicare trustees estimate that an increase of 0.35% of taxable payroll (increasing the 2.9% payroll tax to 3.25%) or a spending reduction of 8% would bring the HI trust fund into balance over the long term.

Medicare is but one component of healthcare spending in the U.S. albeit, the largest “elephant”. Add Medicaid and other government programs and the government becomes the largest consumer of healthcare in the U.S. and certainly, in the world.

The United States spends easily twice as much as other high-income countries on medical care, though utilization rates in the U.S. are very similar to those in other nations. Prices of labor and goods, including pharmaceuticals, and administrative costs appeared to be the major drivers of the difference in overall cost between the United States and other high-income countries.

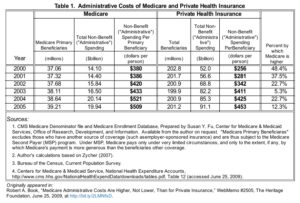

The administrative burden or cost of providing care in the United States, including under Medicare, is astronomical compared to other nations. Under Medicare, often touted as efficient by politicians like Bernie Sanders (only a 2% administrative burden), is far from efficient. Its significant leverage via passing along nearly all administrative cost burden to providers masks the true costs associated with Medicare and having far more beneficiaries and care claims than a private insurer.

In his report to Congress in 2018, the healthcare economist Robert Book Ph.D. noted that while Medicare’s administrative spending was lower as a percentage of total claims, it was actually higher on a per-beneficiary basis. Medicare’s administrative costs were $509 per primary beneficiary, and private plans had an administrative cost of $453 per beneficiary. Dr Book Senate Report 2018

Fixing healthcare spending in the U.S. requires a multifaceted approach, a multi-prong attack. The lowest hanging fruit is found in the incredible administrative burden providers face.

Per a recent Journal of American Medical Association post, just navigating complex plan rules are some of the most frustrating aspects of interacting with the US health care system. In one survey, 24.4% of respondents reported delayed or foregone care due to an administrative task. Another study found the cost of lost productivity by employees dealing with health insurance administration was $21.57 billion and a total annual loss of $96 billion in productivity and employee satisfaction costs resulting from health insurance administration.

Getting specific, and a clear path forward, includes addressing the following. Reducing or fixing just this small sample of administrative burden and costs could readily save the U.S. healthcare system, $500 billion or more annually.

- Per the GAO (Government Accountability Officer) both Medicare and Medicaid are susceptible to payment errors—over $100 billion worth in 2023. Known as “improper payments,” these are payments that are either made in an incorrect amount or should not have been made at all.

- Equalizing payments to stop Medicare from paying for certain services based on location of the service would save $140 billion (conservatively) over 4 years.

- Standardizing claims processes, forms, and systems with simplification, could save as much as $200 billion annually on paperwork, redundancy, staff time and labor costs, etc. In the US, a primary care physician spends $20.49 to receive payment for a service that generates approximately $100 in revenue.4 Improving administrative efficiencies has the potential to save at least $265.6 billion annually, lowering the cost of insurance for employers and potentially the premiums and cost of care for patients, Patient administrative burden in the US health care system – PubMed

- Eliminate or greatly reduced, the burdensome non-care related chores required by Medicare and Medicaid, forced on providers to collect “quality” data that has no correlation to patient care. The government collects and requires, pages upon pages of data collection for various “research” and “reporting” purposes, necessitating untold man hours and costs. Savings from such reduction could easily account for $100 billion annually or more.

- Using advanced technology such as AI to review and remap, simplifying and eliminating, the hundreds of thousands of duplicative and outdate regulations that influence all layers of healthcare, private and public. Reducing and eliminating the thousands of conflicting and overlapping Medicare and Medicaid payment regulations could then lead to a single, common transaction model for US health care. It would not require 100 000 pages of payment rules to implement the digital transaction platform.