As 2017 closed, a number of projects kept me busy right up to the Christmas holiday. Among these projects was a focus on the SNF industry current and its fortunes going forward, principally driven by clients in the investment industry. With REIT troubles, portfolio defaults on the part of HCR and Consulate, Sabra divesting Genesis facilities and Genesis completely exiting Iowa, Missouri, Nebraska and Kansas plus nervousness over rising debt levels and increasing operating expenses (before interest/debt and rent) at Ensign, there is growing concern about “blood in the water”….and when (do) the sharks arrive, particularly for REITs which hold a large number of the physical SNF assets. Back in May of 2017 I wrote a post on the Kindred, HCR, REITs and where the SNF industry was headed. Readers can refresh here: https://wp.me/ptUlY-m7 . For this post, its time to re-examine the industry economically and structurally and the policy and industry dynamics at-play that will affect the fortunes of the SNFs and the firms that invest in them or the industry.

First, its important to understand the general health policy and reimbursement dynamics at-play in the SNF industry.

- Phase II Transition of New SNF Conditions of Participation: Starting in December of 2017, the Phase II survey requirements began corollary to the new SNF Conditions of Participation. Given a fairly aggressive industry lobbying push to CMS and the Trump Administration with respect to “regulatory overreach and burden”, CMS eased compliance requirements but did not abate any survey or compliance requirements related to Phase II. In easing compliance requirements, CMS agreed to not impose remedies for Phase II non-compliance and not to impact Star Ratings under the Inspections component for one year. Given how many SNFs are struggling already with compliance issues and the cost of implementation and compliance, a one-year hiatus for remedies isn’t much of a reprieve.

- Value-Based Purchasing: Beginning in October of 2018 (FY 2019), SNFs with poor performance (below the target) on the 30 day readmission elements measured under VBR will see their Medicare reimbursement reduced by 2%. Conversely, high-performing facilities will see a modest incentive, up to 2%, added to their reimbursement.

- Medicare: In addition to a reimbursement outlook that is flat, a new looming specter has appeared known as RCS-1. RCS-1 is the proposed new resident classification system for reimbursement for SNFs. If CMS pushes forward on the time table noted in the proposed rule, the first phase of changes could begin as early as October of 2018 (FY 2019). For SNFs that rely heavily on the rehabilitation RUGs in the present PPS system, the transition could be expensive and painful as therapy in the new system is UNDER rewarded in terms of “more equaling more payment” and a premium is placed on the overall case-mix including nursing, of the SNF’s Medicare population. Further, lengths of stays are targeted for shortening as the reimbursement model under RCS-1 reduces payment by 1% per day as the resident’s stay progresses beyond the 15th day. While the proposed model is “expenditure neutral” per CMS, there will be clear winners and losers. Winners are facilities that have a balanced Medicare “book” or case-mix (nursing and therapy). Losers are the facilities that have parlayed the “more minute, longer length of stay system”, focused on the highest therapy paying RUG categories. These categories evaporate and the payment mechanics with them.

- Medicaid: This payment source continues to be a revenue center nightmare for most SNFs in most states. Medicaid underpays as a general rule, an SNF, compared to its daily cost of care for an average resident. As a result, the net loss an SNF will achieve for each Medicaid resident day can be minimal to jaw dropping (depending on the State). For example, in Wisconsin, the average loss per Medicaid day exceeds $55.00. This means that for every day of care reimbursed by Medicaid, an SNF must make-up via other payers, the $55.00 loss that comes from Medicaid. An average SNF has fifty percent of its resident days paid for by Medicaid. In a 100 bed facility in Wisconsin (assuming 100% occupancy), the facility loses daily, $2,750. For a month, the loss total expands to $82,500 and for a year, just below one million dollars ($990K). Neighboring states such as Iowa (loss of $12 per day) and Illinois (loss of $25 per day) have better reimbursement ratios per daily cost but present other challenges. For example, Illinois has such overall budgetary problems that annually, facilities must accept IOUs in lieu of payment as the State runs short of funds. Kansas and Missouri had rate cuts this past year. Only two states in the nation in 2016 has surplus rates under Medicaid – North Dakota and Virginia (Virginia is basically break-even).

Adding to this picture are the market and economic forces that provide additional headwinds for many (SNFs).

- Medicare Advantage: 2018 will mark the year where 50% of all Medicare days for SNFs are paid by non-fee for service sources/plans; the dominant being Medicare Advantage. In some metro regions, Medicare Advantage days already eclipse the 50% mark (Chicago for example). Because there remains a surplus of SNFs beds in most if not nearly all markets, the Medicare Advantage plans have been able to set price points/ reimbursement rates below the Fee for Service rate; in most case, minus 10% to 15% lower. Similarly, these plans focus on utilization and length of stay so rates are not only lower but stays, universally shorter.

- Bundled Payments and ACOs: While CMS axed the core of the evolving mandatory bundled payments (hip, knee and cardiac), various voluntary programs/projects are active, fertile and expanding in many markets. The same is true, though less so, with ACOs. As with Medicare Advantage but on a more focused basis, these initiatives seek to shorten length of stays, pay less for inpatient care, and focus on quality providers versus generic market locations. In other words, the incentives for upstream providers (hospitals) under bundled payments and ACOs is to cherry-pick the post-acute world for high quality, highly rated providers and to work to make the overall post-acute utilization as efficient and non-inpatient related as possible.

- Care and Point of Service Advances: As technology and innovation in health care and direct surgical and medical care expand, the need for certain types of care services shifts. Inpatient, post-acute care is seeing its share of “location of care” impact. Patients once commonly referred to Inpatient Rehabilitation Facilities now hit the SNF. Patients that may have gone to the SNF post a knee replacement or even a hip replacement, now go home with home health. With the very real possibility of an equalized post-acute payment forthcoming, the post-acute transformation from a focus on “setting of care determinants” will all but erode. What this means is that occupancy dynamics will continue to change and building environments that can’t be shifted to a new occupancy demand and patient type, will be obsolete.

Given the above forces, policy dynamics, etc., the overall outlook skews a bit negative for the SNF sector in general. And while I may be a bit “bearish”, there are some unique opportunities present for properly positioned, properly capitalized providers. Unfortunately for most investors, these providers and provider organizations are generally private, regional, perhaps non-profit and in nearly all (if not all) cases, not part of a REIT. Some general facts that bear understanding and reinforcing.

- By nearly all quantitative measures and expert reviews, the industry is over-bedded (too much capacity) by minimally 25% up to 33%. This is not to say that any one facility in any one location typifies the stigma but as a whole, a solid 25% of the bed capacity could evaporate and patients would still have ample beds to access. Remember, the average industry occupancy has shrunk to 80% of beds available.

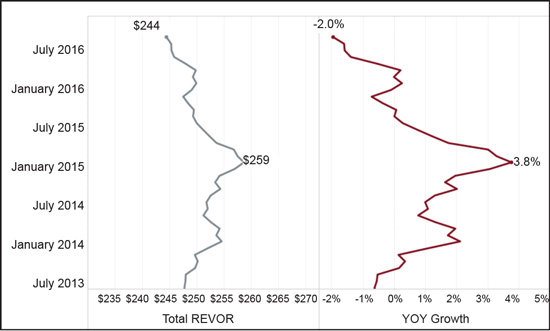

- Average revenue due to reimbursement changes and the impact of Medicare Advantage and “stuck to declining” Medicaid rates, has shrunk on a per day basis and a Year over Year basis; down from $259 per day in January 2015 to $244 per day in July 2016 (negative 2%).

- The average age of physical plant across the sector is greater than 25 years (depreciated life). The average gross age since put into use is older than 30 years. This means that the typical SNF is larger in scope, very institutional, and expensive to retrofit or modernize. In many cases, modernization to private rooms, smaller footprints, more common space, etc. comes at a cost greater than any potential Return on Investment scenario. The winning facility profile today is under 100 beds, all private rooms, moderately to highly amenitized and flexible in design scope and use (smaller allocations of corridor or single use spaces).

- Quality ratings and performance matters today. SNFs that rate 3 stars or lower on the Medicare Star system will have trouble garnering referrals, especially for patients with quality payment sources. It is not easy to raise star levels if the drag is caused by poor survey performance. In a recent review I did for a project, analyzing the Consulate holdings of a REIT (SNF assets leased by the REIT to Consulate for management and operations), the average Star rating of the SNFs was below 3 stars and the 80th percentile, just above 2 stars).

The general conclusion? Watch for another rocky year for the SNF sector and particularly, the large public chains and the REITs that hold their assets. The sector has significant pressures across the board and those pressures are not decreasing or abating. Still, there will be winners and I look for strong regional players, private localized operators and certain non-profits (health system affiliated and not) to continue to do well and see their fortunes rise. A change in Medicare payment to RCS-1 will benefit this group but at the expense of the other SNFs in the industry that have not focused on quality, have a disproportionately high Medicaid census and have used Medicare fee for service/therapy/RUG dynamics to create a margin.