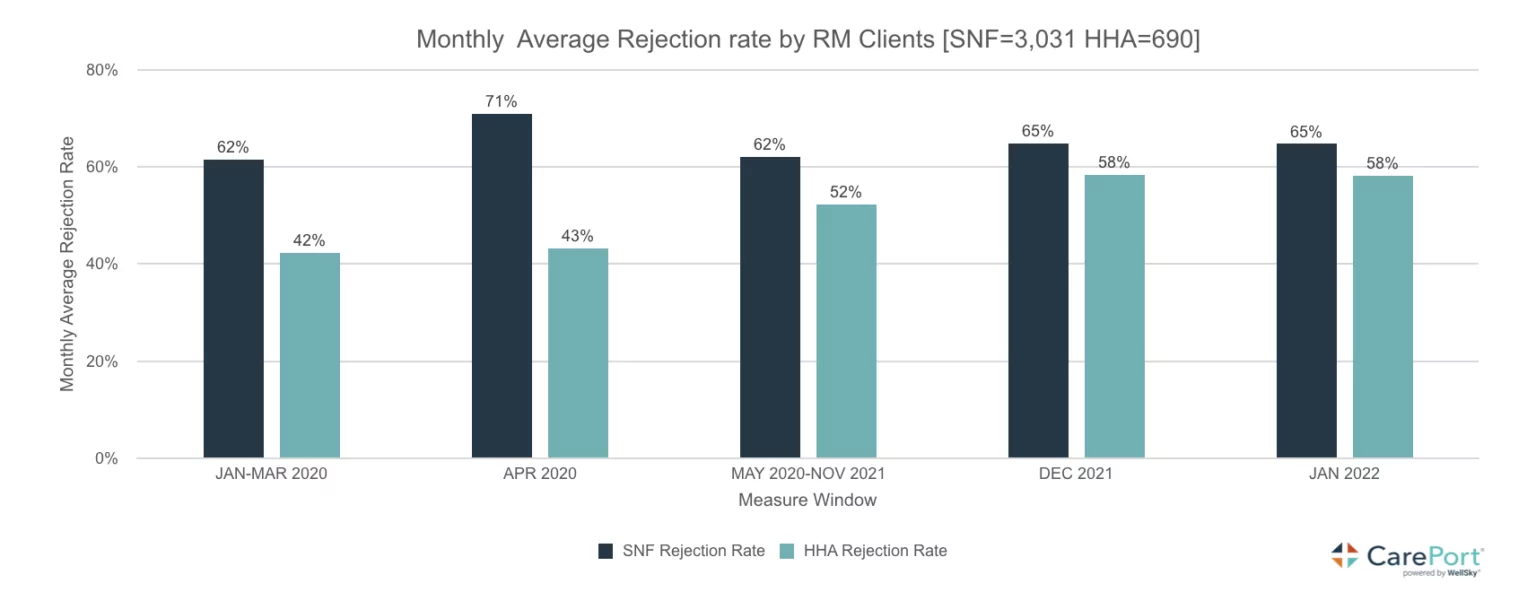

Current economic and government policy conditions have converged to create a concerning trend for home health and SNF providers. The trend for both segments is loosely known as “referral rejection”. The number of referrals that both provider types are rejecting is up considerably since the start of the pandemic and for now, I see no change in direction.

The chart above is a snapshot of the issue across the predominant pandemic periods of 2020 through January 2022. One would expect referral rejections to escalate during this period as outbreaks would necessitate, caution and temporary admission holds, especially for SNFs. Yet, even without a winter breakout of COVID, rejection rates in home health increased to 76% for January 2023. Interesting, during this same period SNF referrals increased by 113%. During the pandemic, the referral lines/patterns crossed as home health from hospital referrals increased and SNF referrals, dipped. COVID period hospitalizations also changed and therefore, overall post-acute discharge volumes during 2020 – 2022 dropped. An in-depth look at hospital volumes and discharge patterns is here: COVID-FFS-Claims-Analysis-Chartbook_2022Q1

SNFs are now garnering more referrals at the expense of home health yet, we are seeing shifted patterns around a number of factors. COVID policy and Medicare policy during the height of the pandemic created a preferential shift from SNF to home and hospital admissions (non-COVID related) were down substantially (elective and other procedures). As hospital admission patterns are recovered to near pre-pandemic levels, discharges have shifted to SNFs, not due to a preferential change but due to policy (reimbursement) and staffing.

Though both provider types share staffing and reimbursement concerns, home health has had the biggest negative impacts from the two. SNFs have certain economies of scale in terms of staffing whereas, home health typically, cannot maximize efficiencies with a caseload spread among various locations. In some instances, smaller caseload blocks are possible but in rural and suburban areas, cases are typically spread such that productivity for therapists and nurses is hampered by travel times. Home Health received a pittance of an increase in their PDGM rates for 2023 and CMS is targeting potential reductions going forward to offset programmatic growth and what it believes, is a rich fee schedule for providers.

Acuity on discharge is also up and thus, home health rejection rates seem to correlate. While home health may remain the preferred discharge location for Med Advantage plans and physicians (and patients), finding an agency that can staff the case let alone deal with a higher acuity patient is problematic in most markets. SNFs tend then, to be the beneficiary of the home health rejection.

One thing is certain in the current environment, the 2o ton gorilla in the room is staffing levels – ability to have sufficient number in sufficient roles (RNs, LPNs, CNAs, etc.) to meet patient needs on referral. Similarly, restrictive Medicare rate increases, with staffing costs rising and costs of doing business the same (insurance, supplies, energy), SNFs and HHAs will both be vigilant on patient needs vis a vis, reimbursement. Small margins can quickly get eaten-up by higher wage cost, agency staff, and patient care supply requirements.

As we approach mid-year, I’ll continue to watch this referral trend and how it manifests in terms of rejections and ultimately, care access. I’m afraid that continuation of these patterns will cause access problems if not for post-acute care services in general, but for preferred care locations (home v. facility based). And while it may be nice for SNFs to see a rebound in referrals, I don’t know too many SNFs these days that are able to occupy full capacity (staffing) and to accept without condition, every referral that comes their way.