Yesterday, the Federal Reserve raised its benchmark interest rate by .25 basis points (one quarter of on percent). The effective rate is now 5.25 to 5.50 percent. This is highest Fed Funds rate in 22 years.

For the past multiple weeks, I have been writing on how the rate progress has impacted (negatively), seniors housing. These impacts are felt in the merger/acquisition market, in the new development market (new inventory almost non-existent), and the sales cycle for CCRCs/Life Plan communities, as well as in the progress (or lack thereof) of capital equipment purchases and capital improvements.

Rate increases will add continued economic pressure to the industry and likely, trigger additional debt defaults. The industry has yet to recover from the pandemic (fully) and labor shortage pressures plus rising costs of capital will continue to provide significant headwinds for further recovery and possibly, lead to a recovery stall or erosion for some.

Higher cost of capital plus lending restrictions will negatively impact the ability of providers to borrow for working capital, to borrow for necessary physical plant improvements, and to borrow for purposes of growth (acquisition, new development). Undoubtedly, projects that were teetering due to rises in the cost of capital may now be dealt a death blow.

In listening to Fed Chair Powell and in reading the Fed Open Market Committee statement, I am puzzled by this move. The Fed statement is available here: Fed Policy Statement July 202

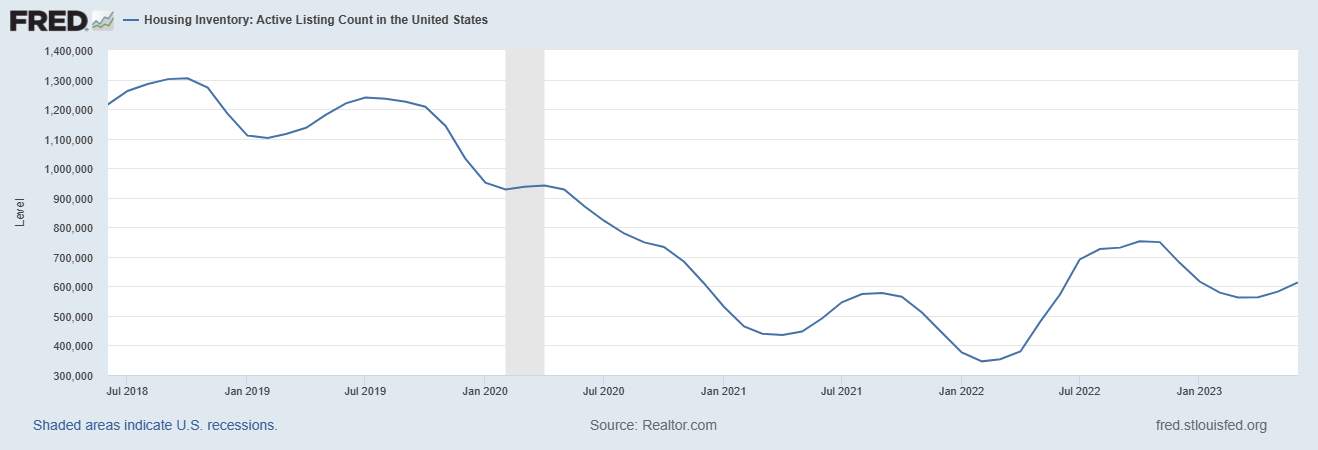

- The housing market is almost entirely crushed. The small rebound recent was almost entirely attributable to new housing and cash purchases. Mortgage lending isn’t happening. The move to further illiquidity will not change the supply of housing which, is at a five-year low.

- The Fed’s goal of achieving a 2% rate of inflation is also rather quizzical. The average rate of inflation between 1960 and 2023 is 3.8%. Headline inflation today is 3% and core is at 4.6%. While not ideal, these numbers have been falling.

- The job market is often cited as a key factor as unemployment remains low and new job creation remains strong. Interesting however, is that these numbers tend to be more headline than economically important. Wage growth is present but real wage growth remains below inflation by almost 3% year over year. Labor participation hasn’t really changed and most job growth is service and governmental. Strip out governmental jobs, look at U6 numbers which are trending upward, and the picture is a bit different. Far less strong, arguably, than what is often reported.

- Energy costs appear to be rising, more detached from rate policy than some other goods and services, such as housing. The concern is that certain inflationary elements/pressures are policy driven and therefore, unlikely to move much by interest rate hikes. If this is more accurate than not, we could see a prolonged period of stagflation whereby GDP growth is minimal if at all, and inflation remains above GDP growth.

- Rate increases have a lagging effect and one that can be insidious, known as demand destruction. Demand destruction of any magnitude creates recession. I would argue that the Senior Housing industry is there right now – depressed and not recovering anytime soon.

Housing Inventory

Historic Inflation

One last note. Milton Friedman (the economist) noted that inflation has one cause: too high a rate of growth in the quantity of money. The source of that growth as Friedman notes is government policy. Governments (encompassing its central bank, the Fed) are the source of this high growth rate of money. The pandemic period created an unprecedented level of new, unchecked monetary infusion without any correlation to output. The Fed simply printed way too much money. Pulling that over-supply back is difficult, especially when governments continue to deficit spend – state and federal. Even less spending, when there is not productive output, is stimulative to inflation. In other words, the Fed’s tools are blunt instruments. My point: watch for collateral damage.