While mergers and acquisitions are generally down, affiliations, closings in some cases, and sponsorship changes in non-profit senior living and care are at a record pace. Back in July, I wrote about the disconnect between acquisitions and the merger/affiliation changes occurring among non-profits. That post is here: https://rhislop3.com/2023/07/24/senior-living-and-care-ma-two-worlds/

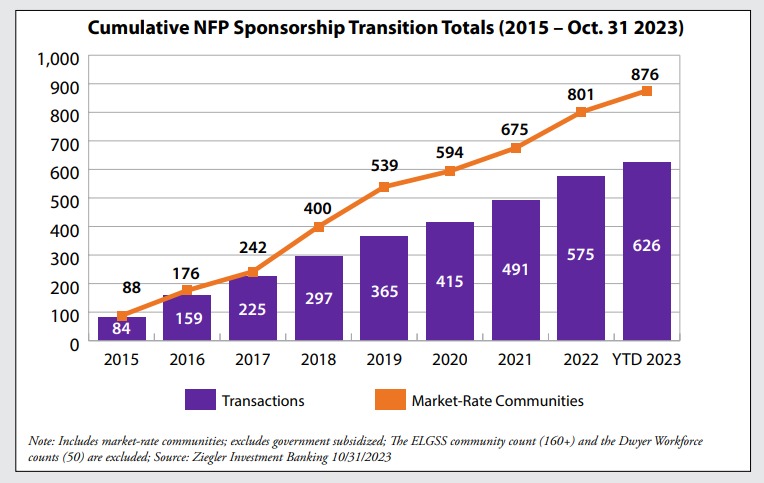

A news release from Ziegler Investment Banking, released this week, indicates that there have been 626 non-profit, senior living transitions through October 2023. This compares to 575 for all of 2022. Since 2015, there have been 876 affiliations, closures, or sponsorship changes per Ziegler. The news release is here: SL_ZNEWS_111323

The acceleration in changes is driven principally, by three factors.

- Current economic conditions, principally interest rates/capital access. CCRCs/Life Plan communities rely on accessing capital efficiently and reasonably priced, for capital projects. Similarly, variable rate debt that is repricing has strained revenues and, in some cases, produced negative cash flow.

- With respect to SNF closures, the drivers are market changes and reimbursement inadequate to cover rising costs. Labor is the chief cost component and the cost related to it, post the pandemic, has risen substantially – faster than changes in reimbursement.

- Market changes in demand post-COVID for some providers have hurt occupancies and caused products, especially among older physical plants in less desirable or less socio-economically viable locations, to be less in demand. Upgrades to the product have become more challenging due to capital access challenges and construction costs.

Providers facing the issues in numbers one and three above have limited options other than to seek affiliation or outright, change of sponsorship or in some cases, change of ownership. In the most trouble of cases, especially among SNFs, change of ownership is the most frequent transition element. Typically, the change has been a sale to for-profit organization (53% since 2015).

Of all the closures since 2010, 70% have been nursing homes/SNFs. The primary reason is reimbursement inadequate to cover the rising cost of operation. Census challenges and demand shifts (shorter stays, etc.), also contribute to the choice to close.

Of course, not all transactions among non-profit senior living/care organizations are due to hardship. In some cases, the non-profit is the acquirer. Some organizations are financially astute, minimally leveraged, and have market strength to grow. Often, the acquisitions are product/service line additions or in some cases, capacity additions. For example, I have done work on behalf of non-profits looking to add home health and/or hospice. The acquisition model is cheaper and faster than a start-up these days, especially one that seeks to become Medicare certified.

In other non-hardship cases, the affiliation is strategic. This occurs when an organization feels that joining with or forming with another entity or entities offers a market and economic advantage. Scale for example, can provide some operating cost relief, perhaps an opportunity for improved access to capital, enhanced outlet (location) opportunities, product enhancement (another organization has services or programs that are desirable), or other economies of scale (technology, labor, infrastructure).

Looking into 2024, I expect this trend to continue. There is no question that the SNF industry will see additional regulatory, financial and occupancy challenges. The average age of plant in the SNF industry continues to increase as little new building has occurred and major upgrades, have severely waned since pre-pandemic periods.

As economic conditions improve, there may be some pressure relief such that single site organizations feel an opportunity perhaps, to reposition. And while interest rates may fall and capital access improve, some of the overall trends that are challenging in senior living/care will remain as headwinds.

- The labor market is not improving such that the supply of direct caregivers will shrink the present level of demand. As this trend continues. so will upward wage pressure.

- The consumer is changing and desiring different product and different living options. Congregate communities are not as desired by the baby boomers as they come into the market. This means that first- and second-generation senior living communities (Life Plan, Independent Living) will continue to serve an older cohort, and a frailer cohort. Older and more frail = more expensive to accommodate in terms of additional services and additional labor.

- Generalized operating costs are higher (not including labor) requiring the ability to charge (rate) more. Efficiencies in terms of operations are harder to obtain now as supply costs, energy costs, and administrative costs (insurance, software, etc.) are up significantly since 2020. Inflation may be abating but prices are not yet, and likely never will, fall to pre-pandemic levels.