Happy 2024! I trust everyone had a blessed and happy holiday season and rang in the New Year with joy and optimism.

Across the last two months of 2023, JAMA (Journal of American Medical Association) has published two studies on private equity ownership in healthcare, specifically in hospitals and SNFs. Not to accuse JAMA of having a bias but the parallel between the two studies/articles is rather distinct. In December, I wrote a post on Federal rules regarding ownership disclosure and SNFs, including how the same tied to concerns about private equity ownership. That post is here: https://rhislop3.com/2023/12/13/wednesday-feature-snf-ownership-transparency/ In addition, within that post is the JAMA piece from November on SNF outcomes with private equity ownership. The JAMA/SNF publication is available here: JAMA Private Equity and Quality in SNFs

As I mentioned, the JAMA hospital feature study is similar to the JAMA SNF piece as both correlate private equity ownership to poorer patient outcomes/poorer quality. In the JAMA hospital piece, the focus is on hospital-acquired conditions namely, events such as infections and falls. The JAMA hospital study is available here: JAMA Private Equity and Hospital Outcomes 12 26 23

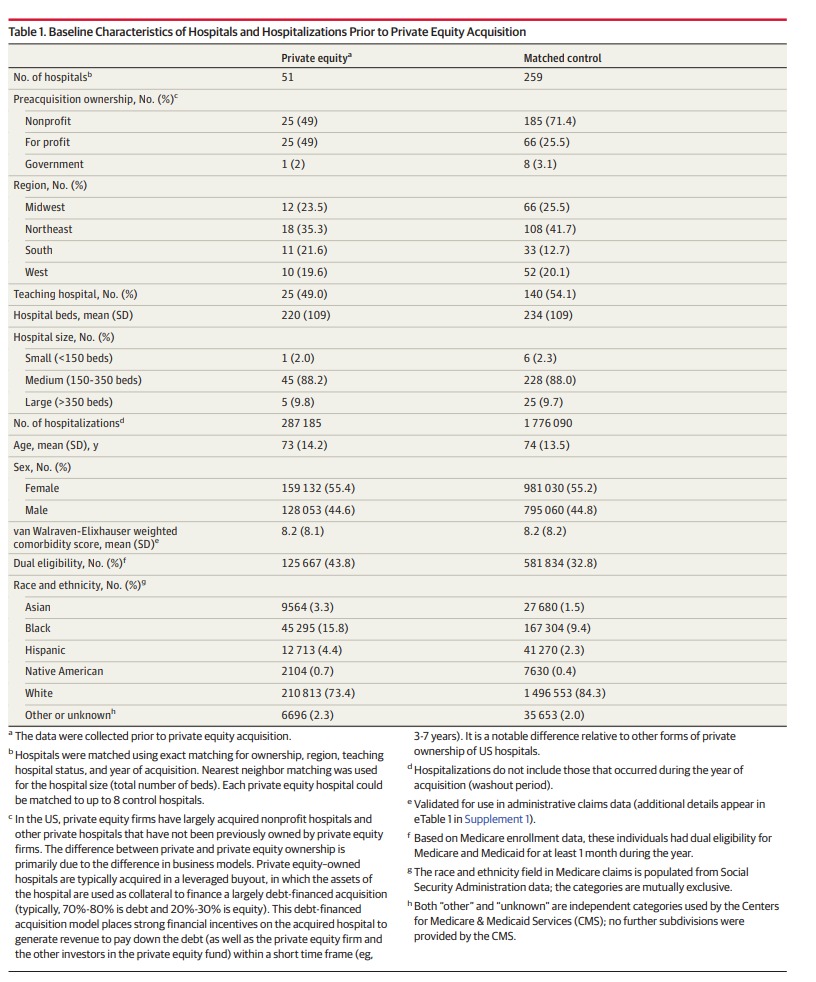

The study reviewed 662,095 hospitalizations at 51 private equity-acquired hospitals along with 4,160,720 hospitalizations at 259 private equity-controlled hospitals using 100% Medicare Part A claims data. They analyzed stays between 2009 and 2019, for three years before and three years after acquisition.

Per the study, private equity owned hospitals experienced a 25.4% increase in hospital-acquired conditions. This figure encompassed a 27.3% increase in falls and a 37.7% increase in central line-associated infections. For some reason, private equity-acquired hospitals placed 16.2% fewer central lines than non-private equity hospitals. Surgical site infections doubled after a private equity acquisition, despite the hospitals having an 8.1% reduction in surgical volumes.

Demographically, private equity hospitals treat fewer Medicare patients post-acquisitions and those that they do treat, tend to be younger and have less existing disease comorbidities. This cohort is also less likely to be dual eligible (Medicare and Medicaid). The study suggests that a contributing cause to the poorer outcomes achieved is lower staffing as private equity investment focuses more on margin and returns and less on staffing levels. The implication is that lower clinical staffing levels, number and type, are major contributors to poorer patient outcomes and experience.

The hospital study demographic data is below.

Interesting to note, discharges from private equity hospitals to skilled nursing facilities and acute rehabilitation facilities increased compared with non-private equity hospitals, although this trend had emerged prior to acquisition. In other words, the hospitals acquired by private equity tended to have higher discharges to post-acute providers.

The study noted that no changes in 7- or 30-day readmission rates were observed. Length of stay among private equity hospitals shortened by 3.4% compared with other hospitals though the trend was longer at private equity hospitals prior to acquisition.

The study authors conclude, a theme found in the SNF study, that private equity investment needs attention or to be watched as the trend seems to portend a reduction in quality of care, post private equity involvement. To note, across my thirty plus year career, the same has been said about for-profit investment/involvement in provider ownership. Over time, that trend has not been corroborated.

What will be interesting to watch is whether or not a similar regulatory approach is taken with hospital ownership disclosure as occurred with SNF ownership. The hospital ownership structures across the country are far more homogenized than the SNF ownership structures, mainly because there really isn’t an individual, small corporation or “mom and pop, family” element in the hospital sector anymore. The trend has become more large, consolidated systems and less, regional or even, municipal ownership.

I’ll keep watch on this issue, private equity involvement in healthcare ownership, as I believe it will continue to grow, not reverse.

2 thoughts on “JAMA Study: Private Equity Ownership and Hospital Outcomes”