Happy Hump Day! Today’s post is shorter than normal as I have to attend a funeral on behalf of one of my partners (also a very close, close friend). His mom passed away recently, and the service is today. She was a wonderful woman, mom, wife, and grandmother and she will be missed by all who knew her, very, very much. RIP Karol Freeland and blessings to all of her family.

Her passing came after a long battle with breast cancer that resulted in cancer elsewhere in her body. During this battle, there was an opportunity for experimental and new drug use as part of her care and treatment. Costs of course, were high.

This past year, I’ve written a number of posts regarding the rising cost of care in retirement, from senior living to healthcare in general. All serve to amplify today’s post. The two most recent are here.

- https://rhislop3.com/2024/01/22/the-cost-of-assisted-living-a-report-from-seniorly/

- https://rhislop3.com/2024/01/03/wednesday-feature-dying-broke/

Recently, I got a hold of a publication from RBC Wealth Management about healthcare costs and planning for them in retirement. The fascinating part of this study is the numbers about the costs. The data RBC shares is eye-opening and if correct, disabling to most adults as they look toward retirement. By disabling I mean most folk (the vast majority) will not have resources sufficient to cover their future healthcare costs. The report is available here: taking-control-of-health-care-in-retirement

A few data points from the report are worth noting.

- 80% of adults are concerned about the cost of future care.

- Only 56% are planning for care costs.

- 50% of those that have done something fear that is not enough.

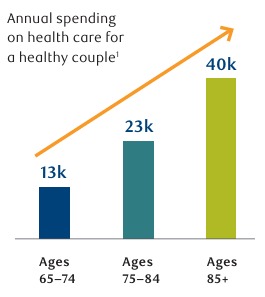

- The Bureau of Labor Statistics estimates that at age 65, annual spend on health care for a healthy couple is close to $13,000 ($6,500 per person).

- The projected lifetime costs for healthcare for a healthy couple retiring at 65 in 2022 was $683,306.

- Medicare covers less than 2/3rds of healthcare costs in retirement.

- For a typical retiree, 68% of their Social Security benefit goes to care costs and that percentage is expected to rise.

So, as I close and wish everyone a Happy Hump Day, a quick message from me on elections and healthcare in the U.S. in 2024. Little has been discussed about healthcare costs in this country so far this election cycle. To me, this is a problem. Border security, war overseas, the economy in general, etc., are big issues, no doubt. The economy for example, is a huge issue and arguably, should be the biggest but not for reasons most people think.

We as a nation, are dying from within economically. We cannot afford the fixed costs we have saddled ourselves with, namely interest costs and entitlement costs. We are aging as a population and our financing mechanisms for programs such as Medicare and Social Security will not currently, keep these programs solvent. In general, we have about an annual $1 trillion gap that needs to be closed by increased taxes or decreased spending or a combination of both. And closing that gap just balances the current budget but does nothing about the cost drivers that remain.

Retirees don’t necessarily have a savings problem (though some do), they have a cost-of-living problem. From housing to healthcare, it is becoming increasingly impractical for someone or somebodies (a couple) to target 65 as retirement age. It is also increasingly improbable that a healthy 65-year-old will not have to work to support his/her future costs of care in retirement. The reality is, we need to seriously and with intention and pace, start to reform programs like Medicare, Medicaid, and Social Security IF they are to survive and provide any benefit to the next generations of retirees.

For me, I will be looking very close at each candidate’s plan for healthcare this election cycle – presidential and congressional. I hope readers and followers, will do the same.