Among the many healthcare sectors I follow, rural healthcare has become my favorite. Oddly enough, it’s not because of the policy issues that exist, though it should be. It is because it is an overlooked sector and one that has a real risk of collapse.

Last summer (2023) I wrote a post about the plight of rural hospitals and the risk of closure https://rhislop3.com/2023/08/21/trouble-for-rural-hospitals/ . Suffice to say, the risk of closure and the loss of services and access continues to loom and worsen.

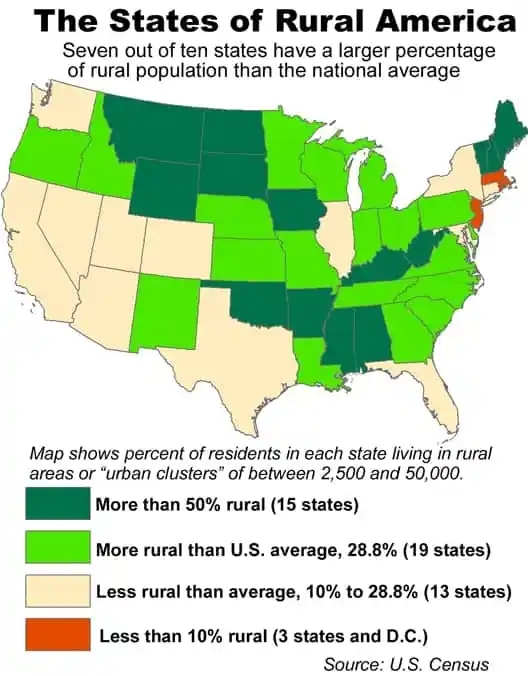

Almost three out of ten Americans live in a rural area or a very small city, according to data released by the U.S. Census Bureau.

That’s the national average or 29 percent of Americans live either in an unincorporated area or in a city of between 2,500 and 50,000 residents.

The national average is dominated by large populations in a few very large metropolitan areas in Texas, California, New York, Florida and Illinois. Most states, like the kids in Lake Woebegone (A Prairie Home Companion), are well above average when it comes to the size of their rural populations.

Seven out of ten states (34 of 50) have more than 29 percent of their people living in rural settings — either in small cities or in unincorporated areas. Fifteen states have more than half their populations living in rural areas or in towns under 50,000 population.

A study just released by the Chartis Center for Rural Health indicates that half of all rural hospitals are losing money and hundreds remain at risk of closure. The Chartis study is available here: chartis_rural_study_pressure_pushes_rural_safety_net_crisis_into_uncharted_territory_feb_15_2024_fnl

In the past year, the percentage of hospitals operating at a loss increased from 43% to 50%. Hospitals that are unaffiliated with a system are faring worse – 55% of independents are losing money. Though system affiliation helps, it does so only marginally as 42% of hospitals within a health system are losing money. Overall, 58% of all rural hospitals are system affiliated.

Highlights from the Chartis Report are below.

- The percentage of America’s rural hospitals operating in the red jumped from

43% to 50% in the last 12 months. - 55% of independent rural hospitals are operating in the red, while 42% of health system-affiliated rural hospitals are operating at a loss. Nearly 60% of rural hospitals are now affiliated with a health system.

- Medicare Advantage now accounts for 35% of all Medicare-eligible patients in rural.

communities. In 7 states, Medicare Advantage penetration exceeds 50%. - Access to inpatient care continues to deteriorate as 167 rural hospitals since 2010 have either closed or converted to a model that excludes inpatient care.

- 418 rural hospitals are “vulnerable to closure” according to a new, expanded statistical analysis.

- Between 2011 and 2021, 267 rural hospitals dropped OB services. This represents nearly 25% of America’s rural OB units.

- Between 2014 and 2022, 382 rural hospitals have stopped providing chemotherapy services.

Rural hospitals are typically classified as Critical Access Hospitals. The Medicare fee-for-service reimbursement for Critical Access Hospitals is cost-based (plus a percentage), allowing these hospitals an opportunity to recoup costs and manage a small margin. As more of the population enrolls in Medicare Advantage plans (50 plus percent in some states), reimbursement has shifted to a designated amount (percentage of fee-for-service) when Medicare Advantage is the payer. As in urban and suburban areas, Medicare Advantage plans differ in payment amounts, typically lower than Medicare fee-for-service. For rural hospitals, this means payments that are not cost-based. Medicare Advantage may not cover all the service Medicare fee-for-service does in rural hospitals. For example, swing beds, which provide skilled nursing care. Swing beds can be a strong source of revenue stability.

Rural hospital closures create ripple effects that are felt throughout the community. Within many communities, the hospital is generally the largest employer and a significant influence on the local economy. Chartis’ analysis “shows that when a rural hospital closes its doors, the loss of hospital jobs is nearly 220 at the median. The loss of non-hospital jobs in the community is 73 at the median”.

In terms of access to inpatient care, 2023 was a record-breaking year for rural healthcare. Inpatient care completely left 28 rural communities, well above the previous high of 18 in 2020. Hospital closures and the loss of inpatient care is the highest in the states of Texas (26), Tennessee (15), Kansas (10), Missouri (10), and Georgia (10).

As a hospital closes, care can become significantly delayed or worse, completely avoided due to access difficulties. Another option post a closure, could be hundreds of miles away. As rural populations tend to be older and suffer from more chronic diseases such as diabetes and heart disease, efficient and convenient (reasonably so) access is literally the difference between increased risks of death or complications. No current policy initiatives in Washington exist of any magnitude. to begin to address this mounting problem.