The U.S. spends more than any other world nation on healthcare – gross dollars and per capita. The systemic growth of spending continues at rate beyond inflation, spurred-on by an aging demographic and chronic diseases like diabetes and obesity. Cost growth in programs like Medicare is rampant but then again, so is fraud.

Federal spending for Medicare and Medicaid has grown by almost 80 percent over the past decade and growth in these and other health programs is projected to continue.

By estimation, of the $4.5 trillion annual healthcare spend in the U.S. (now 17% of GDP). The National Health Care Anti-Fraud Association estimates annual financial losses from health care fraud to be in the tens of billions of dollars. Conservative estimates put these losses at 3% of total health care spending, while some government and law enforcement agencies suggest they could be as high as 10%, potentially exceeding $400 billion.

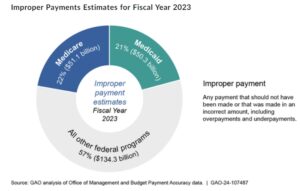

Per the U.S. GAO (Government Accountability Officer) the Department of Health and Human Services (HHS) estimated that the Medicare and Medicaid programs made over $100 billion in improper payments in fiscal year 2023. This accounts for 43 percent of the total estimated improper payments reported government-wide for that year. Medicare and Medicaid: Additional Actions Needed to Enhance Program Integrity and Save Billions | U.S. GAO

The most common types of fraud I see (and follow) relates to providers billing for services that are not necessary, were not provided, or were billed separately as opposed to bundled under one category. The salient, single reason for the predominance of these types of fraud, especially under Medicare and Medicaid, is the economic incentive that exists in the system. In other words, the incentive is more acuity, more procedures, more services, etc., equals more reimbursement. A recent classic example is captured within a post I wrote a few weeks back https://rhislop3.com/2024/08/08/phantom-diseases-and-medicare-advantage-fraud/

In another recent case that continues in the State of New York, the Atty. General sued Centers Health Care with allegations of “repeated and persistent fraud,” accusing the CEO and eleven others connected, of illegally misusing over $83 million in taxpayer funds. This purportedly led to “significant neglect, harm, and humiliation” of residents at four for-profit nursing homes located in Queens, the Bronx, Westchester County, and Buffalo. N.Y.’s largest health vendor linked to owner accused of fraud, neglect (timesunion.com)

The petition (in the case) claims that the respondents consistently participated in fraudulent and unlawful activities by submitting false and misleading Medicaid certifications, breaching various Medicaid program rules, disbursing fraudulent and collusive payments to affiliated service providers, and devising fraudulent real estate transactions predicated on deceptive loans.

With fluidity, cases and claims of fraudulent activity move on.

- Cigna agreed to pay $172 million to resolve allegations that it knowingly submitted and failed to withdraw inaccurate and untruthful diagnosis codes for its Medicare Advantage Plan enrollees to increase its payments from Medicare.

- Martin’s Point Healthcare agreed to pay $22.5 million to resolve allegations that it knowingly submitted inaccurate diagnosis codes for its Medicare Advantage Plan enrollees that were not supported by the patients’ medical records to increase reimbursements from Medicare.

- Cornerstone Hospital Medical Center and related entities agreed to pay $21.6 million to resolve allegations that the former long-term acute care facility knowingly submitted claims for services performed by unlicensed and unauthorized students, and services that were not provided or effectively worthless.

- Smart Pharmacy, Inc. SP2 LLC, and Gregory Balotin agreed to pay at least $7.4 million to resolve allegations that they unnecessarily added the antipsychotic drug aripiprazole to topical compounded pain creams to boost federal reimbursement for the compounded creams and waived patient copayments. The government alleged that the defendants crushed aripiprazole pills approved for oral use and included them in compounded creams used topically for pain treatment, knowing that there was not an adequate clinical benefit.

- Saratoga Center for Rehabilitation and Skilled Nursing Care related entities, and operators and owners Leon Melohn, Alan “Ari” Schwartz, Jeffrey Vegh, and Jack Jaffa agreed to pay $7.1 million to resolve allegations that Saratoga Center delivered worthless services to residents, resulting in medication errors, unnecessary falls, and the development of pressure ulcers, and that the facility’s physical conditions deteriorated to such a degree that the facility did not consistently maintain hot water, have an adequate linen inventory, or dispose of solid waste.

The question that begs, is there an answer for stopping the fraud and concomitant cost and waste? For argument’s sake, I have listed my opinion below, coming from decades of compliance and healthcare executive experience.

- The system under Medicare is trending toward value-based care. The trend needs to be accelerated and tightened. When payment is based on smarter care, tied to outcomes for the patient, fraud becomes much tougher.

- Standardized claims forms and systems, mandated for Medicare, Medicaid, and private insurance. The goal of HIPAA was to get here along with the HITECH Act was to create interoperability and data centric sharing between providers, across the whole continuum. It hasn’t happened. https://rhislop3.com/2018/06/27/interoperability-and-post-acute-implications/

- Realign payments, shifting weight to prevention vs. acuity. The system, especially Medicare, pays more for more (care, procedures, etc.). The age-old adage applies: “What gets rewarded (paid for), gets done”.

- Full price and quality transparency for all provider segments should be required.

- Give the consumer/patient the incentive to seek lower cost, higher quality providers via lower deductibles, rebates, etc. Again, if the consumer has skin in the game (so to speak) and the adage in #3 above applies, the incentives shift.