As regular readers know, I speak at a number of conferences annually. Additionally, I work with financiers and investors in the space literally daily. In all my journeys and conversations, I am still faced with some major myth “debunking” about the nature of the seniors housing and healthcare demand, current. The major myth: Baby-boomers are either here, impactful, or here soon enough that additional supply and different supply is necessary. Nothing is further from reality.

The economist in me wants desperately to provide a full-blown lecture here but I’ll refrain and provide a Cliff’s Note version. Demand is a function of supply and to a lesser extent, vice-versa. The two are interdependent. Demand (commercial) requires a supply of consumers, able and willing to pay a price for a given product. Seniors housing and healthcare, especially housing, has a very elastic demand curve. This means that price is a major influencer in demand. The amount of demand for higher-end, above market seniors housing, is less than the amount of demand for moderate and lower-priced seniors housing (at its core).

Demand is also influenced psychologically hence the “willing” component. Seniors housing requires the consumer to make a psychological decision about moving or consuming, a niche’ product. This fact is supported by the demographic reality that less than 12% of all seniors live in a specific “seniors housing” environment. While a greater number reside within a NORC setting (naturally occurring retirement community) such as a condo complex or apartment complex, the reality is that fully 80% of all seniors at anytime, do not reside in seniors housing nor are they “looking”. The core dilemma with seniors housing is that seniors universally, prefer to live in their “residence” in their community. Some, but a rather small number, choose or are motivated to move annually by choice or by need – the latter being the greater motivator (death, family move, health issue, change in neighborhood, etc.).

Consumers, in this case seniors, exist along the full spectrum of age and ability (economic) to pay. Given the elasticity of demand for seniors housing (the higher the price, the fewer number of able consumers) coupled with a plethora of living options for seniors (home, condo, apartment, etc.), measuring the actual demand for seniors housing is a bit more complicated than most want to believe. The complexity lies demographically and economically.

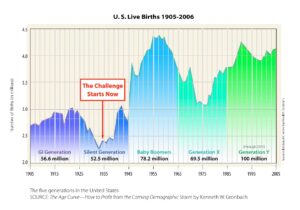

First, the demographics today are not spectacular. While it is true that we have more older adults reaching ages 80 plus than at any time in history, the number of people in this cohort as derived by birth is falling. An individual today aged 80 was born in 1935 – the depression/war years. During this period (depression/war years), birth rates declined precipitously. See chart below.

It isn’t until the post 1945 years and subsequently, into the mid 1950s that birth rates accelerated into what we commonly know as the Baby Boom. Simple math thus tells us that the real expanse of supply of seniors, age appropriate for seniors housing (around age 80) won’t occur for another 15 years minimally. Today, we are actually seeing a reduction in overall “age relevant” supplies of seniors for seniors housing.

Back to the point about seniors housing demand being highly elastic. Fewer consumers (potentially) also means that all consumers by economic status and desire are fewer in number. The point here is that the supply of seniors for higher-end housing is not just smaller in number but smaller in “desire” or motivation. Folks that have the means to spend thousands per month and invest an entry fee of $250,000 to $1,000,000 also have the means to explore multiple different options. In other words, the range of substitute products (alternatives) for this group is plenty and growing. They clearly can afford to remain at home longer, acquire supportive services, or migrate to lifestyle communities or other planned communities that include multiple options and services geared towards “aging in place” (see Del Webb and The Villages as examples).

Today, there is a reason many communities and projects continue to struggle with occupancy. The average nationally remains stuck around 90% and Assisted Living hasn’t broached this level yet – even though projects continue to come forward at a steady clip. A contributing factor? The demographics are not as fluid and as strong now as industry folks want to portray. The industry is in the core openings of the 20th century baby bust. Additionally, not only is this next group demographically smaller, it is economically less well off, by virtue of time of birth, than the cohort preceding and the one following. This is in effect, the double demographic dilemma for seniors housing.

The moral of this present story: Supply of units for the most part, in most regions, is good to surplus. Reinvention in place is what I advise and for growth; acquire – don’t develop. Adding additional inventory is not only expensive it is difficult to support, except in certain markets where certain really good conditions apply, demographically and economically with proper demand analysis. This present condition will last for about the next 10 years and to a certain degree, maybe longer as the age at which seniors seek “seniors housing” elongates – moving into the 80s. Developers need to understand this condition and seek proper demand analysis and economic planning before believing the demographics of “If you Build it, They Will Come!”