Two articles in my email caught my attention to start the week. Both have to do with SNF closure risks, one regarding rural facilities and the other regarding staffing challenges. Interesting enough, both cross the same issues for closure, approached however, somewhat differently.

I’ve written about this subject for years now yet, attention has only become acute as of late. A push-pull relationship between demographic shifts and the post-acute care needs that come with an aging population and the resources to meet those demands, is occurring. With reimbursement, particularly Medicaid (dominant industry payer) not keeping up with cost increases and additional regulatory burdens imposed by the pandemic and soon to arrive, staffing mandates, facilities simply cannot maintain a margin sufficient to operate. The average industry margin in 2023 is negative.

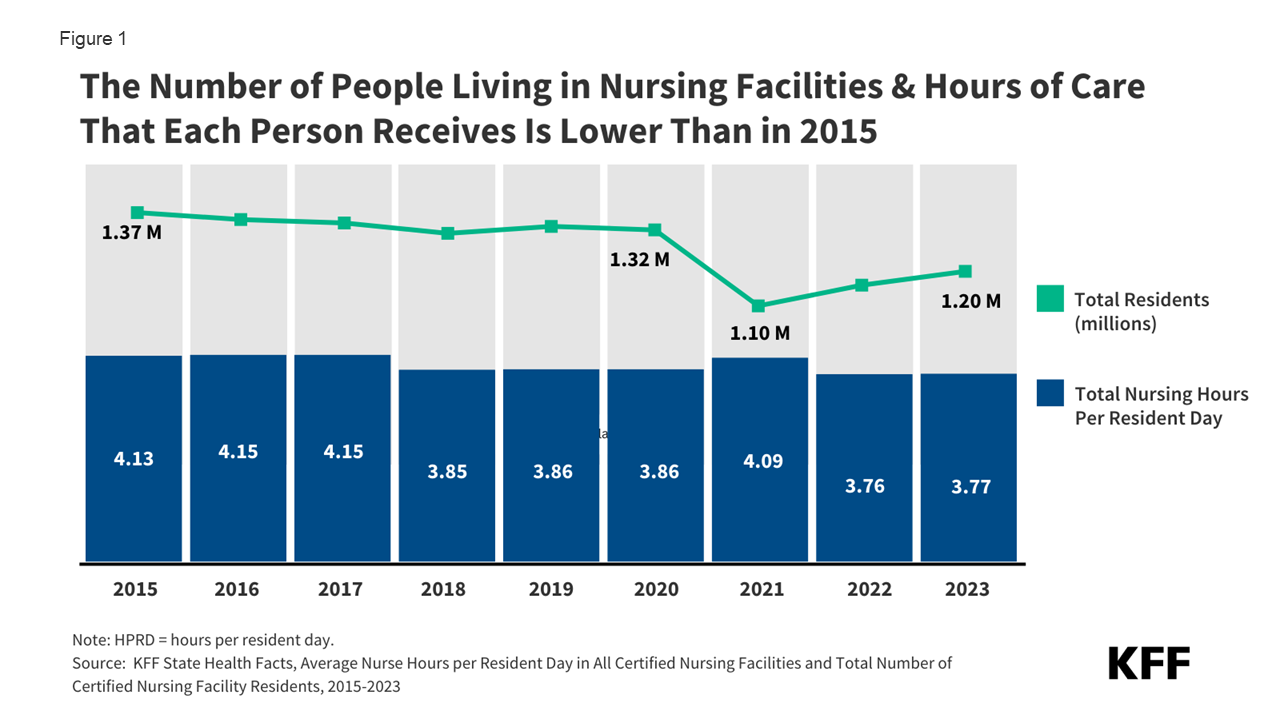

According to a study last week from the Kaiser Family Foundation (KFF) available here https://www.kff.org/medicaid/issue-brief/a-look-at-nursing-facility-characteristics/ ,

- The number of nursing facilities dropped by 4% between 2015 and 2023, and the number of nursing facility residents dropped by 12%.

- Over that same period, the average number of hours of nursing care that residents receive per day has declined by 9% (from 4.13 to 3.77), in spite of the generally increasing acuity levels of nursing facility residents.

- The average number of deficiencies and the share of facilities with serious deficiencies has increased over time, which may partly be the result of decreasing staffing levels. Between 2015 and 2023, the share of facilities with a serious deficiency increased from 17% to 26%.

Between 2005 and 2018, 500 rural SNFs closed according to CMS data. According to a report from the Rural Policy Research Institute, “between 2008 and 2018, 472 nursing homes in 400 nonmetropolitan counties and 783 nursing homes in 368 metropolitan counties closed in the U.S. As of 2018, 7.7 percent of the 3,142 counties in the U.S. had no nursing homes (nursing home deserts); 10.1 percent of the 1,976 nonmetropolitan counties and 3.7 percent of the 1,166 metropolitan counties were nursing home deserts”. The report is available here: Rural NH Closure

Though the primary drivers for closing are similar, a few characteristics of rural facility challenges are more pronounced compared to their urban/suburban peers.

- A higher percentage of Medicaid payers – about 2% more. Quality mix is lower in rural facilities (fewer Medicare and private pay days),

- An overall lower census within smaller facilities. Lower census levels in smaller facilities concentrates expense, especially fixed costs, without much room to spread costs or to achieve economies of scale. In other words, a five-bed vacancy in a fifty-bed facility is far more impactful than a five-bed vacancy in a 100-bed facility.

- More pronounced staffing challenges as lower population centers offer fewer healthcare worker possibilities, particularly concentrated challenges for skilled professionals (RNs, PTs, OTs, etc.).

- Medicaid payments are lower in rural areas, predicated on outdated methodologies incorporating labor regions. The outdate is that rural labor regions are less costly from staffing perspective, where today, that is far from true when it comes to skilled staff.

States like Nebraska (a primarily rural state) lost 15% of its nursing homes since 2018. Sixty of the state’s counties (93) have two or less nursing homes – 18 have no SNF. Oklahoma lost more than 100 nursing homes (2000 – 2022) while the over-60 population increased by 200,000 people.

Even facilities in urban and suburban areas face ongoing survival challenges. The largest challenge is staffing, exacerbated by CMS recently released staffing mandate (https://rhislop3.com/2023/09/01/cms-releases-rule-on-snf-staffing-mandate/). Despite extensive research illustrating that high staffing levels don’t necessarily correlate to improved care (ABT study), CMS is imposing minimum required levels of staffing that today, only about 17% of facilities currently meet, daily. Couple this upcoming challenge with a labor force already short in number of total demand, and economic pressure for SNFs mounts dramatically. Many will not be able to meet the mandate regardless of effort.

Another significant challenge is resource availability via capital markets and reimbursement. Average physical plant age of SNFs places this asset class among the oldest of all healthcare asset classes. Many facilities have not seen significant physical plant upgrades in decades due to margin challenges and today, capital costs and capital access.

Reimbursement levels continue to be a challenge for SNFs in terms of dollars sufficient to cover costs. Reimbursement updates lag costs as the same are incurred, and this has been especially true since the pandemic and the resultant rising costs of staffing. Staffing costs have risen far faster than reimbursement increases, particularly under Medicaid (the largest payer source for nursing home care).

According to MACPAC (Medicaid and CHIP Payment Advisory Commission) “the median facility had allowed payment amounts that were 86 percent of costs. About one-fifth of facilities had allowed payment amounts greater than 100 percent of costs, and 15 percent of facilities had allowed payment amounts less than 70 percent of costs” (2019 data).

Going forward, continued escalating closure numbers are likely, especially given the current and projected trend for labor availability. Opportunities exist for altering this trend, but they principally depend on policy shifts to have reimbursement more directly cover costs, regulatory burdens removed (staffing mandates), litigation protections/reform, survey and certification reform to reduce regulations that have little to do with patient care but much to do with paperwork, etc.