An issue that has been tied to AI (artificial intelligence) and specifically, to Medicare Advantage plans, involves coverage denials. I wrote about this in a post earlier this year at https://rhislop3.com/2023/05/01/medicare-advantage-part-d-final-rule/

Coverage denials have been a fairly hot topic around Medicare Advantage plans. The core of the issue is that Medicare Advantage plans are required to provide the same levels of coverage and benefits as traditional, fee-for-service Medicare, Parts A, B, and D. The Medicare Advantage plans can provide more benefits, but not less.

With Medicare Advantage plans, denials of coverage or benefits could only be appealed to the plan. Claims are administered by the Plan, not by a fiscal intermediary or Medicare Administrative Coordinator. For some time now, providers, particularly post-acute providers (skilled nursing, home health) have been complaining about the use of Artificial Intelligence and other technology to adjudicate lengths of stay coverage and payment levels, based on interpretations of reasonable and necessary. In contrast to Local Coverage Determinations (LCD) made by Medicare Intermediaries and Administrative Contractors, clear differences in coverages were noted with Medicare Advantage decisions being more restrictive than fee-for-service coverage decisions. More on LCD here: https://www.medicare.gov/claims-appeals/local-coverage-determinations-lcd-challenge#:~:text=What%27s%20a%20%22Local%20Coverage%20Determination,of%20the%20Social%20Security%20Act.

MedPAC (Medicare Payment Advisory Commission) has noted this issue as has Congress. Industry lobbyists on behalf of providers and patients have raised specific case concerns. Apparently, CMS has heard the concerns and offered a proposed solution via their proposed rule Contract Year 2025 Policy and Technical Changes to the Medicare Advantage Plan Program (abbreviated). The CMS Fact Sheet is available here: https://www.cms.gov/newsroom/fact-sheets/contract-year-2025-policy-and-technical-changes-medicare-advantage-plan-program-medicare

If approved or as modified, the changes would go into effect on October 1, 2024 (beginning of federal fiscal year 2025).

As is typical in these proposed rules for a particular Medicare provider or program, there are additional changes or tweaks involved. The full proposed rule, released November 6, is here: Medicare Advantage Change Proposed Rule 11 6 23

Focusing on coverage denials, the biggest issue of change in the Proposed Rule, CMS is proposing that beneficiaries would be able to use the same appeal process provided under traditional Medicare. Staff from one of 53 CMS Quality Improvement Organizations would review untimely, fast-track appeals of any Medicare Advantage (MA) plan’s decision to terminate services in a skilled nursing facility, outpatient rehabilitation facility or home health agency.

The rule would also eliminate a requirement that makes (MA) beneficiaries forfeit their right to appeal a termination of services decision when they leave the facility (SNF) or discharge from home health. It also would eliminate a common MA plan twist to an appeal whereby patients who appeal a denial agree to take on financial liability for additional care if the denial is upheld. That provision has often discouraged Medicare Advantage patients, over half of which, have incomes below $25,000.

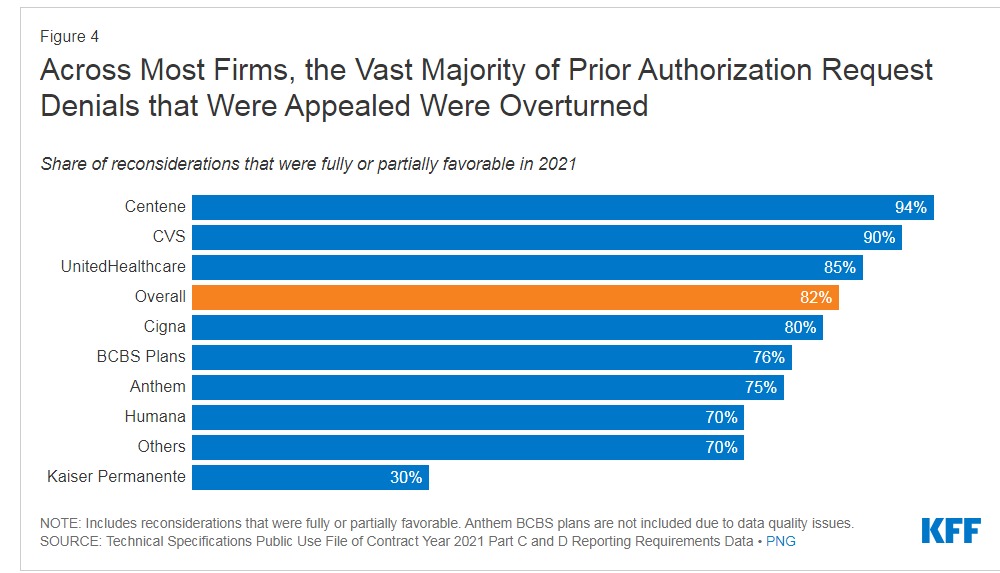

A release in February of Medicare Advantage Plans and prior authorizations (the element tied to coverage determinations and denials) compiled by the Kaiser Family Foundation, found the following (2021 data). The issue brief from Kaiser is here: https://www.kff.org/medicare/issue-brief/over-35-million-prior-authorization-requests-were-submitted-to-medicare-advantage-plans-in-2021/

- More than 35 million prior authorization requests were submitted to Medicare Advantage insurers on behalf of Medicare Advantage enrollees.

- The volume of prior authorization determinations varied across Medicare Advantage insurers, ranging from 0.3 requests per Kaiser Permanente enrollee to 2.9 requests per Anthem enrollee.

- Over 2 million prior authorization requests were fully or partially denied by Medicare Advantage insurers.

- Just 11 percent of prior authorization denials were appealed.

- The vast majority (82%) of appeals resulted in fully or partially overturning the initial prior authorization denial.

With continued growth in beneficiary enrollment in Medicare Advantage plans, coverage concerns will continue to mount. The complexity of the appeal process is an issue, even for fee-for-service beneficiaries. There is no easy or efficient way for beneficiaries to quickly appeal coverage determinations.

The plus, such that is, with fee-for-service Medicare (traditional Medicare) is that providers make the coverage determinations and while not always correct, most providers will error on maximizing coverage and benefits vs. denial. For example, SNFs can and do, readily regulate Medicare coverage lengths of stay but in my experience, the trend is toward longer lengths of stay and date bears that out. The typical difference by common diagnostic codes such as joint replacements, pneumonia, infections is 60% (Medicare Advantage) of a Medicare fee-for-service length of stay. A reflective piece by Kaiser is here: https://kffhealthnews.org/news/article/nursing-home-surprise-medicare-advantage-plans-shorten-stays/

As enrollment growth expands, it was inevitable that CMS would need to provide structural clarity to Medicare Advantage, similar to what is available for traditional Medicare. Medicare Advantage plan popularity is heavily focused on beneficiaries of more restricted economic means, income and estate worth. The appeal of no cost coverage (no premiums), lower cost coverage (modest premiums), and more inclusive coverage (added benefits) and no need of supplemental coverage is attractive for a growing number of seniors. The current economic condition of rising inflation, rising faster than income growth for seniors, with fixed financial means, induces additional interest in Medicare Advantage plans.