TGIF! The U.S. is aging. Its median age is 37.7, just behind China’s median age of 37.9. Comparatively, the U.S. would be considered young in relationship to Japan where the median age is 48.4.

While it is true that the Japanese have a longer life expectancy than the average American (84.6 years vs. 77.29 years), the growth in the Japanese median population age is largely attributable to an exceptionally low birth rate. The Japanese population is declining, and rather quickly.

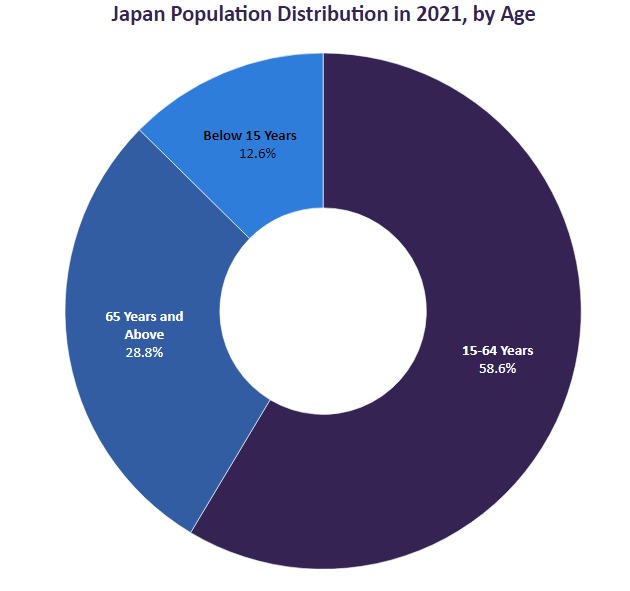

Japan is the world’s oldest nation, measured by attained age across its population, 65 plus. One in ten persons in Japan is over 80. More Japanese are over 65 than are under 18 (29% of the population is over 65). As a result, Japan has an exceptionally high rate of employment for its seniors 65 plus – 13% of the national workforce.

By 2040, 34.8% of the Japanese population will be 65 or older. The economic impact is profound. Japan has approved a record budget for the next fiscal year, in part due to rising social security costs. Prime Minister Fumio Kishida said that his country is on the brink of not being able to function as a society because of its declining birth rate. https://www.bbc.com/news/world-asia-64373950

The reason I chose this topic today is that it is incredibly relevant in terms of U.S. health policy as the U.S. is on a similar path as Japan, just not as pronounced – yet. Consider the following.

- Medicare is the second largest program in the federal budget: 2022 Medicare expenditures, net of offsetting receipts, totaled $747 billion — representing 12 percent of total federal spending. See my post from September on Medicare solvency – https://rhislop3.com/2023/09/18/issue-medicare-solvency/

- Social Security is the largest (non-interest cost) component of the federal budget. In 2023, Social Security will account for 21% of the federal budget or $1.4 trillion. Other than interest on the federal debt ($34 trillion) is presently a larger budgetary item, principally due as of late, to rising deficit spending and rising interest rates/interest cost via rate.

- In 1940, there were 42 workers per retiree. Today the ratio is 3-to-1; by 2050 it will be 2-to-1. The burden on each individual worker will increase substantially (without reform) and the U.S. will no longer be able to keep up payments to retirees at current payroll tax levels.

This is the problem that is entirely visible via the economic malaise in Japan as a result of its aging population. An exceptional piece on this problem is available here: Impact of Japan’s Aging Population Notice the parallels to the U.S.?

Overall, the U.S. birthrate has been in steady decline, though not as precipitously as Japan or for as long. In 2009, there were 13.5 births per 1,000 residents. At the start of the COVID-19 pandemic, the birth rate dropped to 10.97, and ticked up slightly in 2022 to 11.1 births per 1,000 residents. Today, the rate is just slightly above China at 1.6 births per woman vs. China’s, 1.28. China is also rapidly aging and facing severe economic problems from a lack of workers to support its economy.

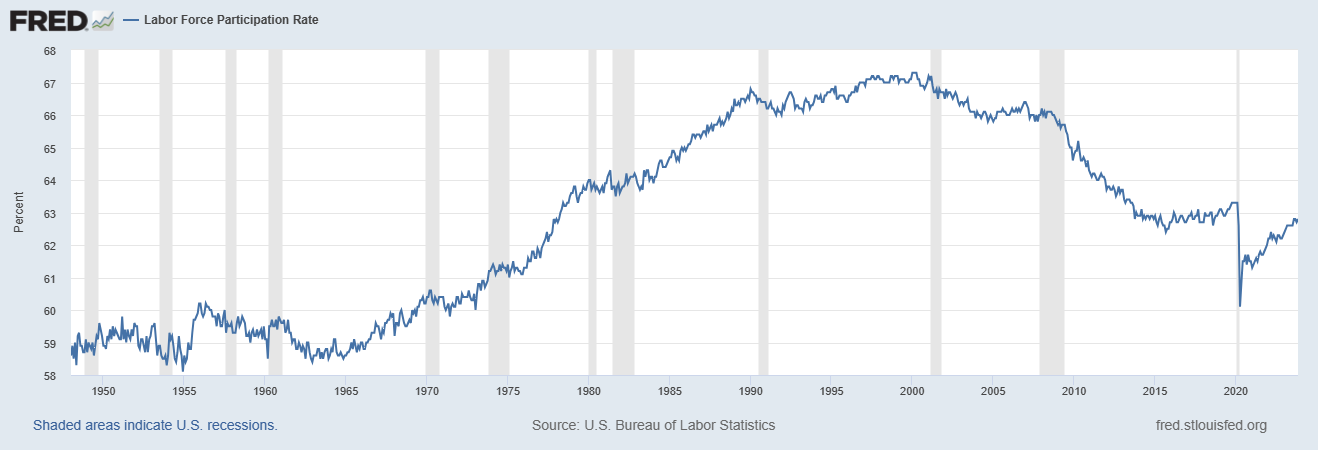

Since 2000, the labor force participation rate has declined. This is due to two factors. First, increased subsidies for unemployment for longer periods. Second, the aging workforce in the U.S. – more retirement. In 2000, 67% of the population was working or looking for work (the participation rate is the percentage of the population that is either working or actively looking for work). In November of 2023, the labor participation rate was 62.7%. This level is insufficient to keep up with job growth via population change and entitlement spending, supported by payroll taxes from work.

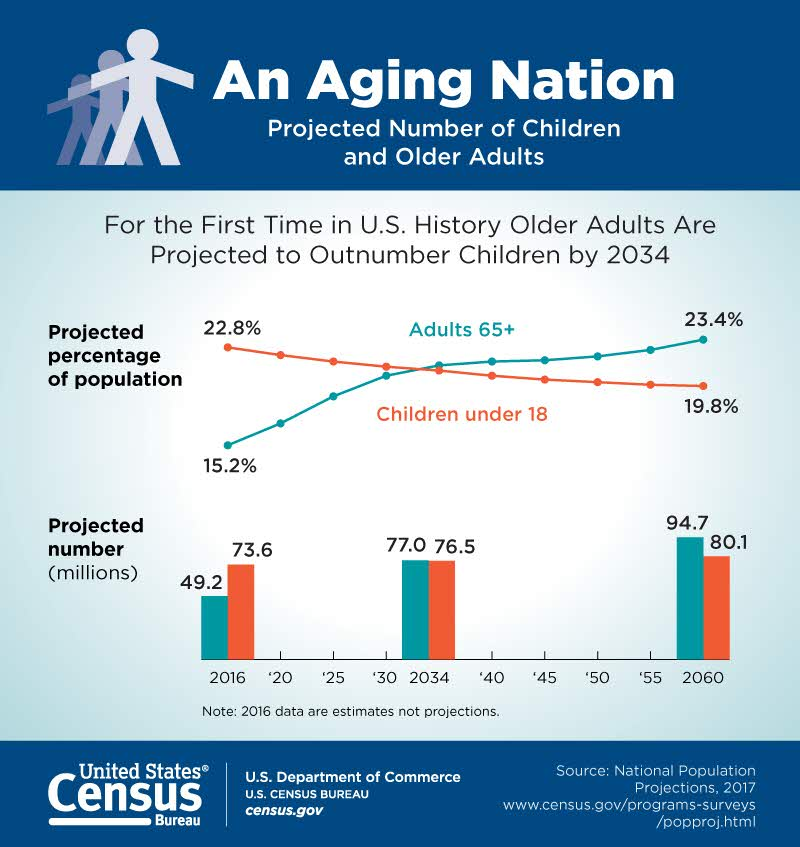

According to the U.S. Census Bureau, the U.S. will reach a point similar to the population shift in Japan when, by 2034, older adults will outnumber children. This same trend exists in Europe. What has slowed this progression and may move the crossover point a few years back is immigration. The U.S. birthrate (among citizens) is not keeping up with the population shift into older years.

The economic implications of this aging trend are profound. The U.S. funding mechanisms and policy for programs such as Social Security and Medicare are predicated on a different demographic structure than exists today and will into the near future. If Japan is a harbinger, then the U.S. can expect a similar structural decay in its economy. In an election year where 100% of the House is up for election, 33% of the Senate, and the Presidency, policy discussions should be forefront regarding this trend and the rising costs of an aging society. Minimally, the following issues should be openly reviewed, and policy positions should be on the table for examination.

- Workforce participation, percent of the population employed, and productivity continue to be down or declining. This means economic output is constrained and labor supply constraints will continue. Supply of labor insufficient to meet demand will create higher wages (not a bad thing necessarily) but not proportional to productivity. More pay for stable output or declining output is inflationary.

- Payroll tax funding based on workforce numbers is brittle already and insufficient to fund current entitlement programs such as Social Security and Medicare. Both programs have sunset dates (deficits) upcoming. Without changes in funding, the current path creates defaults in the next decade or sooner.

- With more citizens converting daily to senior citizen and retirement status, the percent of the population dependent on social programs and structures increases. As this group ages, their disability level increases, causing additional pressure on healthcare and post-acute/senior living systems to meet rising demand. Unfortunately, as this demand increases, supply constraints will become even more visible as insufficient caregiver labor is available to meet demand.

- An aging population consumes differently than a younger population. Demand increases for services such as healthcare and products such as pharmaceuticals and OTC supplies but wanes for housing, major appliances, vehicles, and even certain food products. A shift in consumption in and economy that is consumption driven, will change the economic inputs/outputs proportions and shift perhaps permanently, the U.S. standard of living and the U.S. role as the largest economy in the world and its sovereign currency status.

On those somber notes, I do wish everyone again, a Happy and Prosperous New Year! TGIF!

2 thoughts on “Friday Feature: The Economic Impact in Aging Countries”