On Monday, a good portion of the U.S. saw all or portions of a total eclipse. If you were in the “zone of totality”, you saw a heck of a show and witnessed the side-effects of day turning to dark and the weather turning noticeably colder. Cool stuff.

Unfortunately, within the past week or so, the eclipse wasn’t the only thing that appeared “dark” or light reducing. Recent economic news in the forms of the March jobs report, the March inflation report, and today’s March produce price report illustrate a rather gloomy economic picture. For healthcare providers hoping for some commodity price reductions and improved capital access, the same are not on the near-term horizon. Here’s why.

Jobs Report: The headline seems encouraging that labor and jobs remain strong as per the report, over 300K jobs were created in March, stronger than forecasted. Lately, these reports have been subject to some fairly big revisions in the months following release, though news coverage of those revisions is scant.

The jobs report comes in two pieces via survey – the Establishment (workplace) and the Household (individual homes and workers). I’ve been watching jobs reports for decades and what I am noticing over recent years is the survey participant numbers are declining, likely the reason for the large revisions. The March report is available here: March 2024 Jobs Report

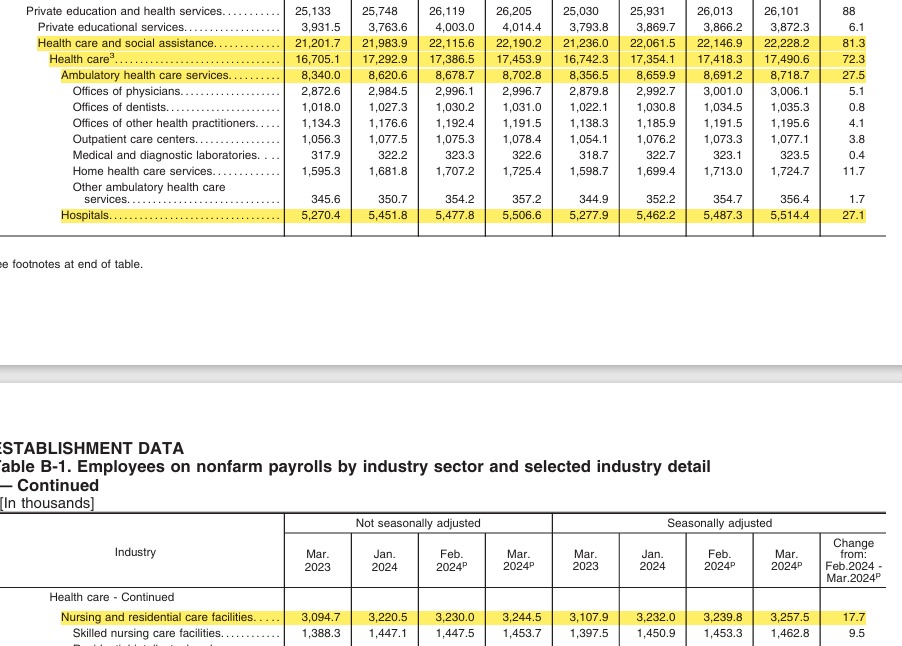

As I dug through the report and the tables, a few very interesting trends and data points come forward. First, the majority of jobs created are in government and then, healthcare. Leisure and entertainment were also big contributors. There were, however, no new manufacturing jobs.

OK on my end to see healthcare continuing to grow with one caveat – who/what is funding the growth. As healthcare is largely driven by government consumption via Medicare and Medicaid, the jobs tend to be analogous to government jobs. A big part of our economic woes with inflation are due to government spending versus private sector spending and investment.

Another data point to note and a trend that is disturbing if it continues, is the decline in full-time jobs and the increase in part-time jobs plus the number of people who are working multiple part-time jobs. Part-time jobs rarely come with substantial benefits if any benefits. A key concern for me is again, healthcare (needing govt. healthcare vs. private insurance) and the lack of retirement plan options. Most workers are tragically short in their savings for retirement and without a retirement plan option at work if work is part-time, the gap will only widen (savings v. necessary savings for retirement).

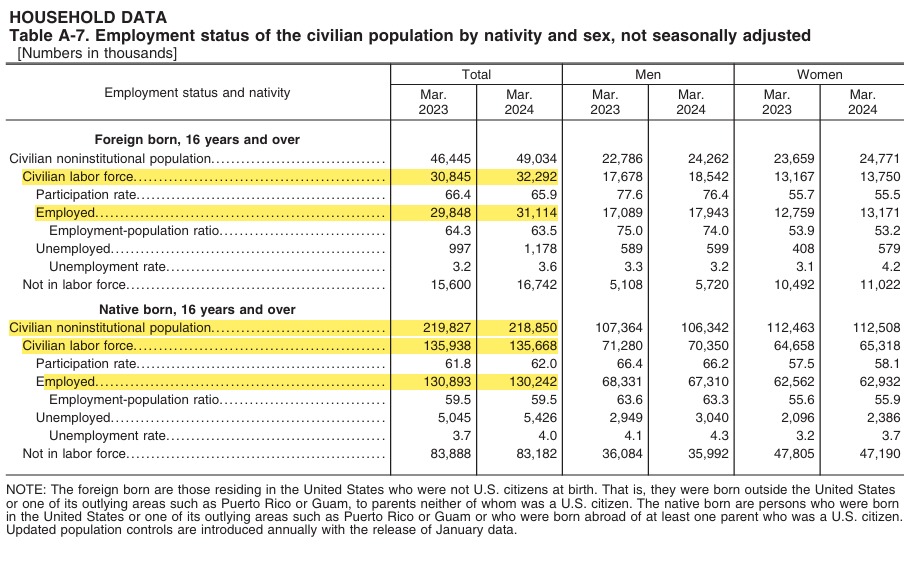

A final point of concern with the jobs number is the decline in native born (U.S. born) workers in the workforce. A driver of current inflation is the subsidy (government money) of non-work that occurred during COVID. Government funds flooded the economy to compensate for lost jobs due to pandemic closures/shutdowns. Those funds amounted to trillions of dollars that, without a correlating output (increase in GDP) by definition, are inflationary.

The trend evident is that U.S. workers are declining and the job growth and jobs, are being consumed by foreign born workers. This paints the picture of the loss in full-time labor, growth in part-time workers, non-growth in private manufacturing, and growth in lower wage industries such as leisure and hospitality – again, dominated by part-time positions.

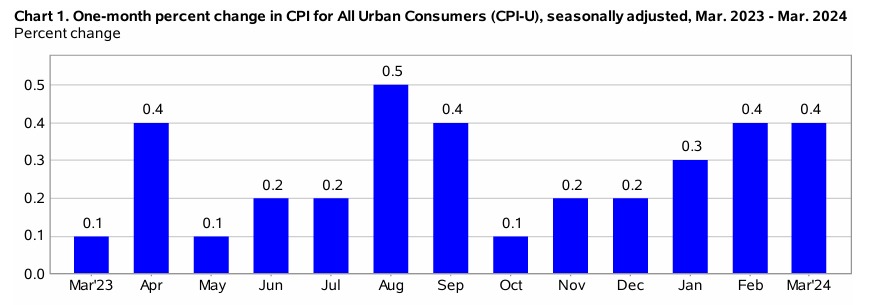

March CPI Report: Inflation data came in hotter than expected, rising again .4% for the month after a similar increase in February. This is the third consecutive month of an increase in inflation. The full or headline number came in at annualized at 3.5% (February at 3.2%) and the core, removing the elements of energy and food, came in at an annualized rate of 3.8%. The drivers were energy (gasoline primarily), shelter (housing which has been steadily rising), food away from home, and auto insurance. Shelter and gasoline/energy combined were half of the contribution to March inflation. For a good number of periods prior, gasoline prices were helping or reducing the inflation numbers. A portion of the boost came via the Biden Administration’s release of oil from the petroleum reserve. Those releases have stopped. Middle East tensions and conflicts have increased oil futures and current OPEC stance of supply constraints, have further increased raw oil prices (raw meaning prior to refined). The CPI report (my highlights included) is available here: CPI March 2024

A couple of important notes about the CPI report, and to a certain extent, parallels that apply to senior living/healthcare. First, the level of sustained inflation suggests that Federal Reserve action to lower rates is less probable in the near term, perhaps not at all this year. Some would say, me included, that the current rate level is not restrictive enough to slow inflation (meaning higher is necessary). I am however, not in favor of additional rate increases as the problem is on the spending side and rate increases without concomitant spending decreases, won’t do much other than push the economy into recession. Without rate cuts, borrowing rates will remain high and credit access, tight.

Second, if rates do as I believe, remain where they are, variable rate debt that is set to re-price will do so at current elevated rates. Treasury yields are rising, and all other lending benchmark indices are doing the same. Re-priced debt could challenge some providers or push them into default – already at decade high levels.

Finally, for entry fee communities, the housing market is not going to be any more fluid or liquid, any time soon. This means seniors may find continued difficulty selling their homes. The residential real estate market is highly illiquid in certain price ranges today and credit for new home buyers, expensive with increased terms (down payments, income tests, etc.). The older adult home (sale) is the principal source of entry fee funds.

March PPI Report: PPI came out today and it actually, was a touch better than expected. The numbers, however, were nothing to cheer about in many ways. PPI is the Producer Price Index and it measures the cost of inputs, for goods and services, that foreshadow retail or end-user prices.

For March, the index increased .2% versus an increase of .6% in February. Among the largest decreases was certain foods like grains, eggs, and turkeys, though somewhat offset by beef increases, chicken, pork, and fresh vegetables. Fuel oil also had a big decrease though this is (almost) entirely attributable to excess supply due to a warmer winter, especially in the northeast.

Almost all of the PPI increase or change is found in final demand for services. A driving element in this sector is wage increases due to insufficient supplies of labor. Home health, hospital, hospice, and nursing home care all contributed to increases in the PPI (services). Wage related inflation is classified as wage-push inflation or more simply, higher wages in turn, cause higher prices. The PPI report is here: ppi report March 04

Concluding, the economic conditions that have been a stiff wind for all of 2023 appear to be holding or perhaps, worsening in some regards. Labor will remain a challenge but, this is a demographic reality. Commodity prices are increasing and that is concerning for all provider types but more so, brick and mortar providers. Capital costs will remain high and capital markets and bank lending, access restricted (though no more so than in 2023). I’ll be watching Federal Reserve reactions and commentary to see if anything solidifies regarding future moves – rates up or down. For now, hold tight as the sea remains rather stormy.