Private equity investment in the nursing home and assisted living sector (other post-acute as well) continues to be a focus of regulatory activity in Congress. This is despite private equity investment in the nursing home sector to be involve about 5% of facilities.

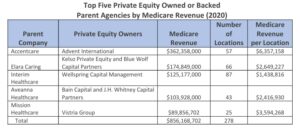

Home health has seen an increasing investment interest as well from private equity investors. In 2023, private equity was behind 5.7%, or about 492 of 8,591 total providers. The top five home healthcare companies account for about 63% of total

revenue by private equity owned or backed companies and 57% of their locations.

Yesterday, Senators Warren and Markey from Massachusetts introduced a bill titled “Corporate Crimes Against Health Care Act 2024”. Per the Senators, the bill’s purpose is to “root out corporate greed and private equity abuse” in nursing homes, assisted living communities, home health agencies, hospices and other “healthcare entities.” The bill text is available here: Corporate Crimes Against Health Care Act 6.11.24

The bill’s provisions would apply to nursing homes, assisted living communities, home health agencies, hospices, hospitals, freestanding emergency departments, health systems, physician practices, ambulatory surgical centers, behavioral health treatment facilities and renal dialysis facilities that are owned or controlled by real estate investment trusts, venture capital funds and private funds.

The concern expressed by the Senators, and others in the Biden Administration (and even trade associations like LeadingAge) is the rapid and deep involvement of private equity/private investment capital, in healthcare. While private equity invests in all industry sectors, the year-over-year growth rate for private equity acquisitions in healthcare is larger than that for private equity acquisitions across all other industry sectors.

According to the text of the bill, if passed (in my opinion, unlikely), the legislation would,

- Establish a new criminal penalty ranging from a minimum of one year to a maximum of six years in prison for executives whose actions lead to a “triggering event” causing injury or death.

- Grant state attorneys general and the Department of Justice the authority to reclaim all forms of compensation, including salaries, from private equity and portfolio company executives within a 10-year window surrounding a “triggering event” that leads to significant, preventable financial distress in an acquired healthcare firm.

- Institute an associated civil penalty up to five times the amount recovered.

- Forbid federal health program payments to entities that sell assets or use them as collateral for loans to a REIT, except for existing agreements; abolish a tax code provision that permits taxable REIT subsidiaries to influence healthcare entity operations; and eliminate the 20% pass-through deduction for REIT investors introduced in 2017.

- Mandate that healthcare providers with federal funding disclose mergers, acquisitions, ownership changes, and financial details, including debt and earnings ratios.

- Direct the Health and Human Services Office of Inspector General to submit a report to Congress within three years of enactment, assessing profit-driven practices in healthcare delivery, such as cost-cutting, revenue-boosting, overbilling, up-coding, inflated patient assessments, compensation tied to revenue or profit increases, staff cuts, caregiver replacement with technology, and service adjustments for higher revenue.

In March, the Federal Trade Commission, Department of Health and Human Services, and Department of Justice sought public feedback on a Biden administration initiative aimed at tackling “corporate greed” within the healthcare sector.

Recent trends have raised concerns that transactions may yield profits for firms at the cost of patients’ health, workers’ safety, and the affordability of healthcare for both patients and taxpayers. The departments have issued this Request for Information to solicit public input on the impact of transactions involving healthcare providers, including those offering home- and community-based services for individuals with disabilities, facilities, or ancillary products or services, carried out by private equity funds, other alternative asset managers, health systems, or private payers. The Request for Information is available here: FTC-2024-0022-0001-Request-for-Information-on-Consolidation-in-health-care-markets Comments were due June 5 and as the same become available, I will follow up.

More on regulatory activity pertaining to consolidation and private investment focuses on healthcare is at this link. Private equity, consolidation divide aging services sector as multi-agency effort gets underway (mcknights.com)

What is important to note in the discussions around private equity, consolidation, investment, etc., is that healthcare providers are struggling with new economic realities post-COVID. Operating costs are up, margins are constrained, labor resources are scarce and not improving, reimbursement trends remain below cost increase trends, and capital markets and traditional lending sources such as banks, have been tough to efficiently access for providers. Non-profits have been especially hurt by capital access issues. The regulatory concerns have some merit but frankly, the bigger issues are endemic today (capital access, economics, reimbursement, regulation) to the industry. Addressing these issues would be far more beneficial to the industry than trying to find more ways to constrain investment and add additional regulations.