The bifurcated title for this post (twofer) means two quick subjects, wrapped into a “what’s next” for 2025. The wrapper in this case is marketing, a subject that I’ve often written about across this blog’s dozen plus year history (hard to believe it has hung around that long).

According to NIC (National Investment Center), and I know this to be true, occupancies have rebounded nicely since the end of the pandemic/public health emergency. Bolstering the rebound has been an economy that has for all intents and purposes, curtailed nearly all new development. The result is a demand v. supply imbalance allowing existing providers to have market preference as few if any new units, are moving into the market and tapping the growing demand. Demographics are favorable to the demand trend yet; the occupancy growth has not come without a cost. 3Q24-NIC-MAP-Market-Fundamentals

Per NIC,

- Overall senior housing occupancy increased by 0.7% in the third quarter, to 86.5%

- The number of total occupied units continues to increase, setting another record level.

- The leading cause for the overall occupancy level growth has been minimal inventory growth, year-over-year at 1.1%

- Asking rent increased 4.2% from prior year levels.

The cost for this growth has been rate concessions along with, a heavy use of paid referral sources (think A Place for Mom).

As I have written before, I’m a fan of Bild & Co. and their founder, Traci Bild. The work they do is impressive, especially in terms of data gathering and analysis around pricing strategies. The graph comes from one of their recent analyses. Q3-2024 Senior Living Market Survey Analysis: Senior Living Concessions | Bild & Co. Excluding CCRC entry fees, the most common incentives, per Bild, are as follows:

- No specials offered Q1(63%), Q2(57%), Q3(51%).

- Reduce/discount rent Q1(11%), Q2(15%), Q3(22%).

- Waive/reduce community fee Q1(9%), Q2(11%), Q3(10%).

- Others: veterans, moving costs Q1(8%), Q2(5%), Q3(5%).

Per Bild, and I think this is definitely true, rate increases are stabilizing after high single digits and low double digits during and immediately after, the pandemic. The average rate increase was 3.93% in 2022, and it rose to 4.02% in 2023. Rates in the third quarter increased an average of 5.01%, a 1.01% increase compared with all of 2023, and a 0.4% increase over the second quarter of this year. The highest rate increase Bild saw in the third quarter was 10%, and the lowest was 1%.

Bild anticipates seeing much more consistent rate increases into 2025, hovering between 6% and 8%, rather than the double-digit increases seen coming out of the COVID-19 pandemic. The days of 3% to 5% rate increases are gone, primarily due to sticky-high inflation costs and labor supply challenges forcing providers to continue to pay more for staff and for contractors.

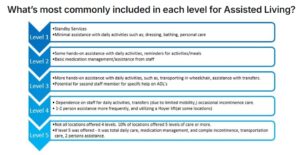

Another interesting trend that I picked-up from some data from Bild is the shifts around care level fees in Assisted Living and Memory Care. Care levels are typically defined as assessment driven, categorized into some elements of resources used, time, and required engagement of various skilled professionals (when applicable). In short, the more care a resident needs in theory, the higher the charge.

Per Bild,

- 46% of locations offered care through a point system.

- Assisted Living offered care services at the average cost of $1,304 per month. Memory care costs averaged $2,547 per month.

- 38% of Memory Care locations were all inclusive. 42% of all locations included some care in base rent but had additional charges after a certain amount of care was exceeded. 20% of locations did not include care costs.

- Assisted Living averaged $48 per day for care costs, while Memory Care averaged $84 per day for care costs.

Care level charges are rarer in Memory Care (more all-inclusive pricing). Per Bild’s data, 38% of Memory Care locations were all inclusive. 42% of locations included some care in the base rent but had additional charges after a certain amount of care was exceeded. 20% of locations did not include care costs.

Assisted Living by comparison, costs less overall and when care level charges are applicable, the costs are also lower ($48 per day vs. $84 per day on average for Memory Support). In Assisted Living, about 75% of all facilities charge extra for some services, care levels notwithstanding. For example, wound care or restorative care (not Medicare covered) would come at an extra fee. Some ALs will use outside providers (home health agencies for example) to provide additional care and in turn, affording the resident access to Medicare benefits. A good read on the Assisted Living costs is here: Extra Fees Drive Assisted Living Profits – KFF Health News

With respect to marketing and pricing trends for 2025, the following are my observations. For reference, in May of 2023, I wrote about the road ahead for 2024 and the influential factors at play, at the time. Much remains the same. https://rhislop3.com/2023/05/04/senior-housing-marketing-bumpy-road-ahead/

- Price increases will continue to be above Social Security increases and generalized consumer inflation. The biggest driver remains labor costs.

- Occupancy trends will remain strong as new unit supply via construction remains well below demand. Interesting enough, residential housing starts are looking bleak as well.

- More providers will look at either reducing care levels to a fewer set or eliminating them all together. Personally, I like this strategy as pricing becomes more uniform and it is easier for the consumer (resident and families) to understand.

- More providers will reduce their utilization of paid referral sources. First, the sources are becoming more expensive (rate increases, etc.). Second, the sources have proven to have some flaws in their referral matrices, supporting certain candidates not for care expertise but for other factors (e.g., pay for play schemes). ‘Free’ For-Profit Senior Services Referrals: Buyer Beware

- Opportunities for providers to differentiate among market competition remain strong. Better service definition, staffing levels, affiliations and strategic partnerships with complimentary providers (home health, hospice, therapies) all offer strategic marketing advantages.

- Affordability remains a market challenge. Providers that can create more affordable options will be significant winners.