I’ve been rather busy lately and my wife’s side of the practice (compliance, litigation), very much so. Suffice to say, as the two prime partners and owners of H2 healthcare, we work collaboratively and support each other. In other words, her “busy” is mine too and vice-versa.

So today, I’m setting aside for catch-up and a bit of later afternoon, R&R with her. Monday/Tuesday, we are taking time away from “work” to head to the Iowa State Fair! Its election season so not only will we “fair it up” with “fair, fare” and sights and sounds, but hopefully catch a stump speech or two. Love to catch a couple of candidates and get their takes on health care and where they see their campaigns going (and term in office if lucky enough to get elected). I’ll obviously, sum up any news we gather.

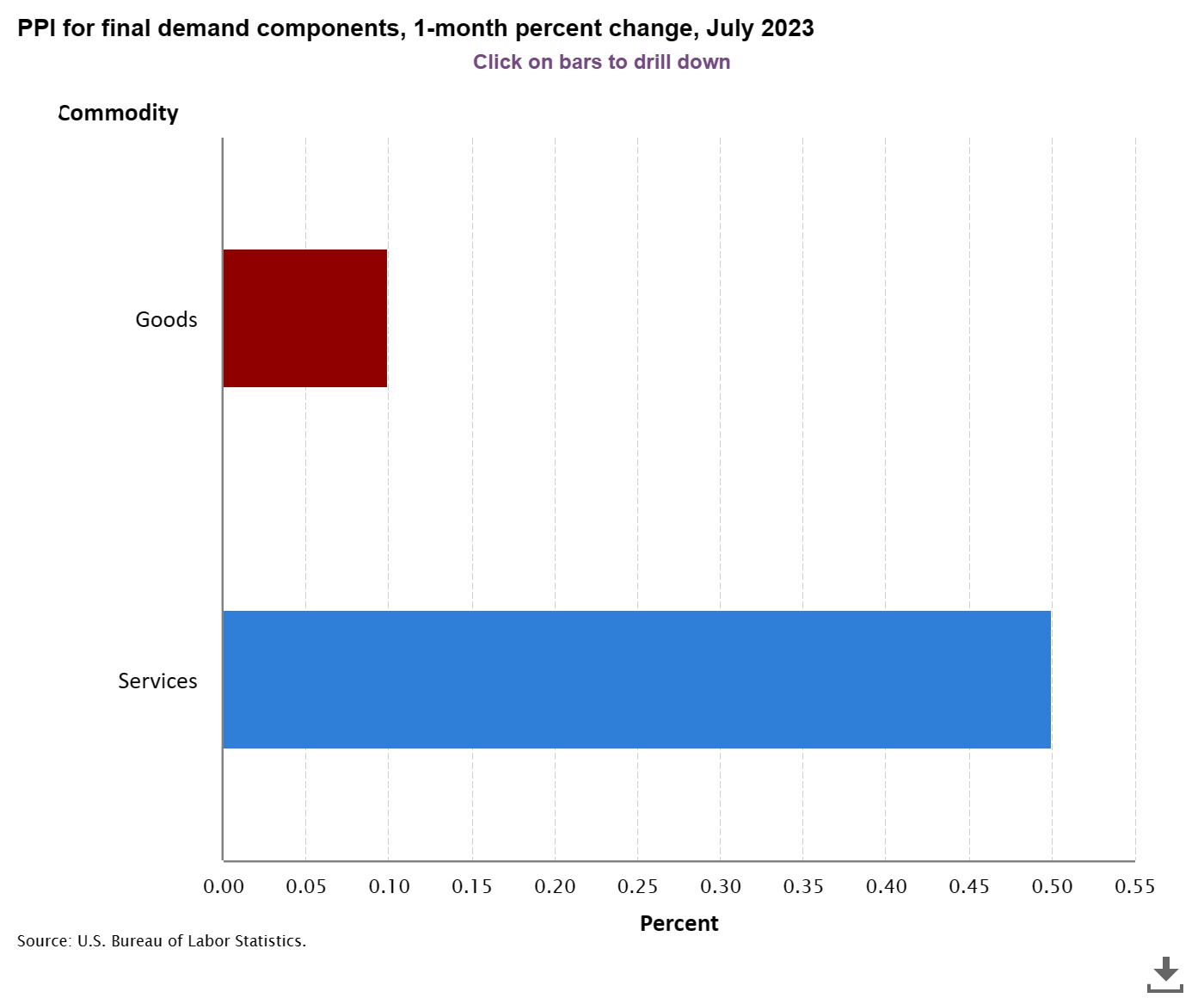

New posts in the hopper so updates will resume Monday. One ‘hit’ for today: PPI (producer price index) came in a bit hotter than expected. Final service demand was the culprit. Final Demand for Services rose 0.5% driven by trade services at 0.7% and transportation and warehousing at 0.5%.

Final Demand for Goods rose 0.1% driven by food at 0.5% but then offset by drop in prices for diesel at 7.1%. Overall, the PPI index for final demand rose by 0.3% compared to June at flat and May at a decrease of 0.3%.

What does this mean? A bit of concern that the fire of inflation remains smoldering and could, with increasing energy costs and stubborn food costs, push through to the consumer side. The Fed sensitizes its outlooks as core, minus volatile food and energy components. I think the CPI print earlier this week gave most some hope of a neutral rate increase stance but now, the PPI puts the real possibility of another quarter point hike, back on the table. Future data, especially jobs data, etc., will ferret out this picture. The PPI reports is available here: ppi July 2023

TGIF!