As the economy continued to struggle through a high inflationary cycle with restrictive Federal Reserve policy in-place to curb inflation, providers struggled to stay afloat in the turbulent economic waters. Significant financial headwinds in 2023 have only modestly abated at the start of 2024.

- Labor supply issues (shortages) of direct care staff (other disciplines as well) has driven compensation costs higher, faster than reimbursement increases. Providers in some cases, have had to use significant bonus plans to attract or retain staff or rely on high priced agency staff to fill vacant positions.

- Supply and commodity inflation has increased faster than revenues from occupancy gains or reimbursement. While inflation has moderated as of late, prices have NOT declined, save declines in certain energy elements like fuels. Food, non-medical supplies, medical supplies, and pharmaceuticals have all risen dramatically across the past 18 months, ahead of any reimbursement increases.

- Capital market constraints and lending constraints due to higher rates, bank failures in early 2023, and now, restricted or constricted lending conditions have limited provider capital access. For providers with floating rate, non-hedged debt, rising rates increased debt service costs, again at levels faster than revenue increases for the same period.

A report released last week from Gibbins Advisors, a health care consultancy focused on turnarounds and restructuring engagements, highlights the Chapter 11 (bankruptcy) filings between 2019 and 2023. The report is available here: Gibbins-Advisors-Healthcare-Bankruptcies-Full-Year-2023-Report-FINAL

Some highlights from the report are,

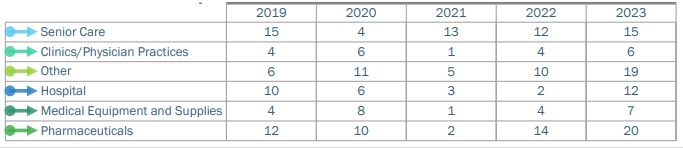

- There were 79 health care bankruptcies in 2023, the highest in five years (51 in 2019). Filing volumes were three times higher than in 2021.

- Large filings, over $100 million, were 28 in 2023, compared to 7 in 2022, and 8 in 2021.

- The number of filings increased for six consecutive quarters, though there was a decrease in the fourth quarter. This may or may not be indicative of a trend change for 2024.

- Hospital bankruptcies were at their highest level since 2019 – 12 filings compared to 11 (total) for the previous three years.

- Senior care and pharmaceutical related bankruptcies made up nearly half of the cases in 2023, consistent with 2022, though greater in number.

- From the report: “Despite the absence of senior care bankruptcy filings in Q4 2023, based on our knowledge of the market we expect to see senior care bankruptcies return in 2024. As for total case volume, we are seeing a lot of distress in healthcare as the market remains very challenging for providers, so we expect to see continued levels of healthcare bankruptcies in 2024 that we saw last year.”

A breakdown of filings by number and sector is delineated in the chart below.

Heading into 2024, the headwinds and turbulence for providers fundamentally remains, though some outlook optimism is warranted, particularly for the capital markets and lending conditions. If, as seems likely, the Federal Reserve will shift from a restrictive monetary policy to more neutrality or accommodative policy via rate cuts, capital costs will moderate, even if initially minimally, and lending access may gradually improve. Slower inflation is also moderating price increases though price decreases are likely only to occur with a recession.

Reimbursement increases will continue to be less than some of the inflation trends but are likely to at least, marginally be better for the next rate year or so, at least in some sectors. Personally, I never like to bet on the government in terms of reimbursement, to be a revenue hedge against rising costs. Home health is a sector that is struggling mightily with labor challenges yet, reimbursement is on the cusp of a cut vs. an increase for the next fiscal year.

I expect, like most analysts and industry watchers, 2024 to be almost as challenging as 2023. Recession is not off the table by any means and global volatility, especially in the middle east, could shift positive reductions in fossil fuel costs, back to a negative (rising) trend.

2 thoughts on “Record Bankruptcies in Health Care in 2023”