While it is important to celebrate that senior living occupancies are up to pre-pandemic levels, it is also important to note that in most cases, the data quoted via NIC for example, is regionalized and nationalized. Likewise, the results (the occupancy levels) are still not capable of generating strong, positive margins. Occupancy levels in the 87% to 88% range are (generally) break-even and depending on whether incentives such as rent abatement or rent reductions were used to gain some incremental units, the margin may be negative for some sites.

The task for most senior living providers going forward is to build on existing demand and if possible, where staffing accommodates, push occupancy into the 90% plus range. We know the demand is there but converting it to occupancy via move-ins, is the challenge, especially for sites that are not “care centers”.

Separating out the “need” driven prospects as they are seeking accommodations for a problem or condition of some urgency, the other remaining residents potentially in the demand queue are best classified as “hidden”. They are there but the question is, what motivates them from being shoppers to being buyers. A recent report from Roobrik Insight Solutions provides insight into this “hidden” group. The report is available here: Roobrik 2023 Mid-Year Report Senior Livings Hidden Market Audience Snapshot

As I have written many times across my career, senior housing, particularly IL (market rate and above) properties and Life Plan communities have a demand curve that is very elastic. Price and economic conditions such as the residential real estate market conditions, have a great deal of impact on how strong demand actually is as measured by conversions to unit sales; sales without extensive incentives.

I am a proponent that every community, especially Life Plan communities and primarily IL communities, should use an analytical approach to developing their respective market and sales plans. The Roobrik report is one tool that provides a data framework that communities can employ within their own markets. A piece I wrote back in 2012 provides some additional details on my strategic marketing approaches – https://rhislop3.com/2012/04/19/ccrc-marketing-reality-check-up/

Some interesting insights I took from the Roobrik report are below.

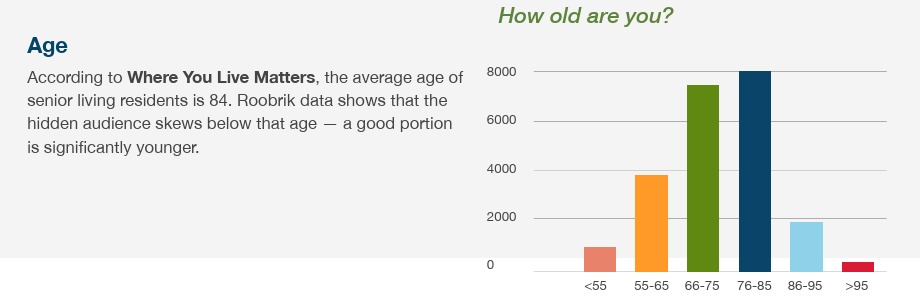

- While the average age of a senior living resident is 84, the folks that are shopping are by age, just below this data point. This is the target group that I typically refer to as the, “I’m not ready yet” cohort. From a marketing standpoint, this is the group to engage and provide reasons for them to convert from “not ready” to “ready and let’s go”.

- In terms of the drivers for a decision to move, the majority of folks that are looking into senior living state that current or future care needs (personal, spouse/significant other) are a key determinant. I have counseled communities about this element, especially Life Plan communities, for decades. Too often, the focus for a Life Plan community is residential, Independent Living, or the amenity, real estate element of the community. This data confirms what I have counseled for a long time. The IL stuff must be competitive, but buyers are really interested in the care services, what they are, how they can be accessed, how good they are, etc. Life Plan organizations with deep service capacity and great care reputation and ratings will outperform their competitors in weaker positions.

- Aside from affordability (resident being able to afford the change/move), the two largest barriers to making the move decision are lack of knowledge or feeling uncertain about day-to-day life and then, confidence that the decision made was the right decision, for the right reasons. Getting past these two barriers requires having skilled sales counselors and polished, sales tools.

For example, getting past the day-to-day obstacle can be handled with a “vacation” program – stay and play kind of thing, similar to what timeshare programs were (without the sleaze or the hype). Having a solid community engagement program is also important. Community engagement programs bring local, non-resident but qualified seniors, to the community for programs that emphasize the community, the lifestyle, the programming in a soft, non-intrusive way. Also, getting existing residents to invite their community contacts to the site for programs works well.

Reassuring the decision is as simple as getting the prospective resident aligned to what matters most to him/her/they and their lifestyle, health choices, family dynamics. This can be accomplished via sales tools (I have many), sales training for counselors, using centers of influence, and sharing histories of other residents that were in similar circumstances and then connecting the parties.