Bunches (pun intended) of economic data the past two weeks and as readers can tell from the title, I’m getting a little “punchy” with all the data. Anyone about my age should recall a celebrity known as Tiny Tim. His fame, short-lived as it should have been, including playing the Ukulele and signing in a high, falsetto voice. Among his few, most well-known songs is Tip Toe Thru the Tulips. I borrowed a portion of the title from my memory of this ridiculous song. https://www.youtube.com/watch?v=zcSlcNfThUA

Last week, I grabbed data and looked at a report from Genworth’s Cost of Care report (https://rhislop3.com/2024/03/14/analyzing-the-2023-cost-of-care-survey-trends-in-long-term-care-rate-increases/). Today, I’ve had a chance to digest more traditional economic data from Altarum and their Health Sector Economic Indicators Brief. Comparing the two, Genworth focused on the cost of care (senior living) from a resident/patient perspective while Altarum focuses on economic data in terms of spending, utilization, labor costs, etc. for the healthcare industry and related segments. The Altarum Health Sector Brief is here: Altarum-March-2024-HSEI-Combined

Interesting observations from the report worth noting are,

- Healthcare spending grew between January 2023 and January 2024 by 6%, to 17.4% of GDP.

- GDP change year-over-year, same period, was 5.1% – below the healthcare spending increase.

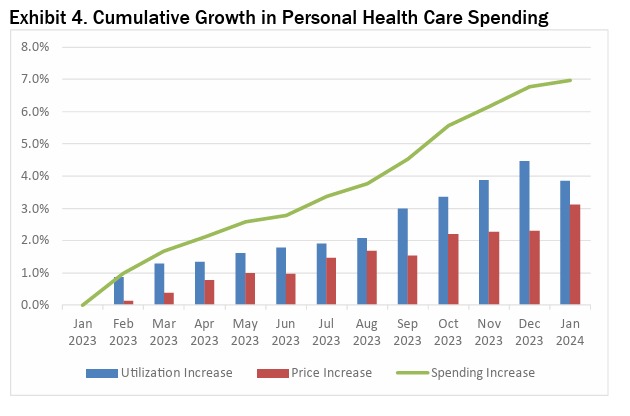

- Personal healthcare spending grew for this same period by 7%, the majority of the growth attributable to utilization increases vs. price increases.

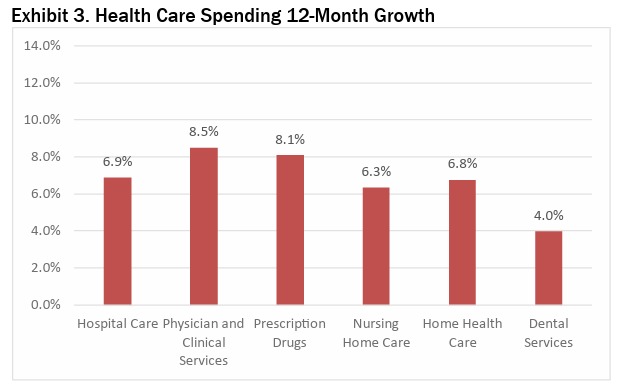

- Physician and clinic related expenses spending grew the fastest year-over-year (Jan 23 to Jan 24) at 8.5% while spending on dental care grew the slowest at 4%.

- In terms of labor and employment, job growth (openings) in healthcare was 7.7% in January of 2024 but hiring (fills of openings) was less than half – 3.2%

- Healthcare employment trends remain strong, averaging a touch over 60,000 per month year-over-year. February was bit stronger at 66,700.

- January 2024 healthcare wage growth was 3.5% while other industry growth was 4.5%.

- Wage growth in health care settings was highest in nursing and residential care facilities, at 4.5% year over year, followed by ambulatory health care services at 3.4% and hospitals at 2.7%.

The overall Health Care Price Index (HCPI) increased by 3.2% year over year in February, increasing slightly from

the revised growth rate of 3.1% a month prior (up from 2.9%). This is essentially in-line with the twelve month change in CPI of 3.2%. Among the major health care categories, price increases for dental care (4.9%), nursing home care (4.2%), and hospital care (3.6%) grew the fastest, while prescription drug price growth was only .3% in February. Health care utilization growth fell slightly to 3.9% year over year in January, but continued to drive spending increases as it remained above overall health care price growth. Prescription drugs (7.7%) and physician and clinical services (6.6%) were the fastest growing utilization categories, while use of dental care (-0.8%) declined and increases in nursing home care utilization were also

small (1.4%).