With reports from the Bureau of Labor Statistics out this past week, the job market remains relatively strong and healthcare within the market, similarly strong. Unemployment remained at 3.6% and labor participation remained at 62.6% (same for last four months) and the percent of the population employed remained at 60%.

For the month of June, non-farm payroll increased by 209,000 jobs. Government was the strongest creation segment, 60,000 jobs. Healthcare was the next strongest segment at 41,000 jobs. Within the 41,000 jobs, 15,000 were in hospitals, 12,000 in nursing homes and residential care facilities, and 9,000 were in home health. Through June 30, healthcare has created an average of 42,000 jobs per month compared to 46,000 per month for 2022.

Average hourly earnings continue to climb. This trend is reinforced by a large supply of jobs with too few people still participating in the job market (below pre-pandemic levels). Scarcity of workers drives wages higher. The increase in June for average wages was +12 cents or 0.4% to $33.58 per hour. Over the past twelve months, wages have increased by 4.4%. Inflation for the same period was 6.3% so real wage growth remains nearly 2% behind inflation. The BLS June report (summary) is available here: https://www.bls.gov/news.release/empsit.nr0.htm

A survey conducted by NIC (National Investment Center) sheds additional light on the staffing challenges that continue in senior living/senior healthcare. In general, staffing is improving with participating organizations (20%) reporting less than 5% of positions still open. In April, only 5% of the organizations had this lower level of position openings. Almost half of the organizations indicated that their independent and nursing care segments were now occupied at pre-pandemic levels. Staffing as I have written before, can be a key influencer (positive or negative) to occupancy levels.

Based on survey data for the prior 18 months, between 90% and 99% of participating organizations noted staffing shortages. As of June, 82% now report staffing shortages. Improvement is clear but not rapid.

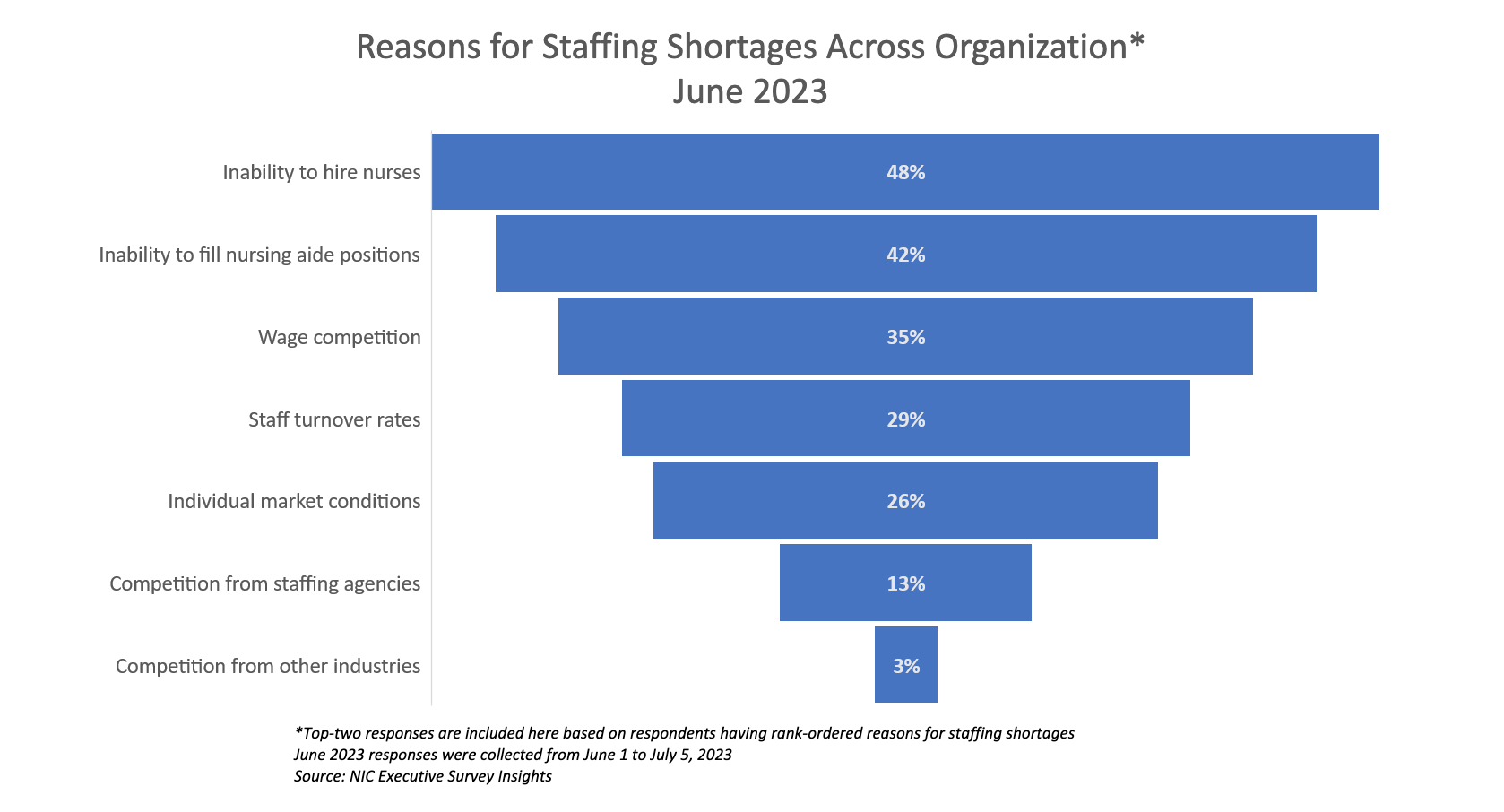

The two top factors driving staffing shortages are an inability to hire nurses (cited by almost half of respondents (48%)), followed by an inability to hire nursing aide positions (42%), wage competition (35%), and staff turnover rates (29%). The greatest influencer of vacancies remains supply in most markets. The number of qualified individuals looking for clinical, direct care openings continues to be less than the number of openings. This has driven turnover and wage competition and the same will continue for the balance of 2023.

Filling vacancies where recruiting efforts fail has lately, been sub-contracted to staffing agencies, though agencies have had their share of difficulty recruiting staff. Agency fills come with a hefty price tag, especially for professional staff. It is not uncommon to find agency rates at a premium of 25% to 50% (higher) than regular hourly staff rates. Other common complaints regarding travel or agency staff include non-compete limitations for staff, requiring liquidated damages from staff or the next employer if the agency staff member gains employment elsewhere, and agency staff that are recruiting (on bonus) from the agency while working at a provider client.

Because of the rapid growth of staffing and travel agencies and the pervasive use of agency staff to fill vacant positions, various states and the federal government, have either enacted legislation or had legislation pending. Below is a quick recap of enacted or pending legislation pertaining to staffing agencies.

- Federal: Bill in the House and Senate known as the Travel Nursing Agency Transparency Study Act, which would require the GAO to complete a study and issue a report to Congress on,

- the difference between how much nurse staffing agencies charged health care institutions and how much they paid their contracted nurses,

- the extent to which agencies could provide transparency regarding these payments,

- how federal funds were used to pay such agencies during COVID-19 related workforce shortages, and

- the effect of market reaction in states that imposed caps to travel nurse pay.

- Connecticut: Passed a law requiring agencies to register with the state and pay an annual fee, effective Jan 1, 2023.

- Must submit annual cost reports with revenues and costs.

- Provide the average number of nursing personnel along with the average fees charged by labor type and healthcare facility (e.g., RN working at a hospital vs. RN working at an SNF), along with the states of residence of the nursing personnel.

- The law requires the State’s Department of Social Services to review rates and to set maximum allowable rates for charges at SNFs.

- Iowa: Passed a law requiring agencies to register (and pay a fee) with the State’s Department of Inspections and Appeals, effective July 1, 2022.

- Restricts agencies from limiting the employment opportunities of health care workers, including the use of non-compete clauses in any contract with a health care worker or health care entity using agency staff.

- Forbids contractually requiring liquidated damages or other compensation if a health care worker becomes a permanent employee of a provider where he/she worked.

- Requires agencies that place healthcare staff at Medicare or Medicaid participating providers to submit quarterly reports to DIA detailing the average amount charged to the provider and the average amount paid to the staff member.

- Illinois: Amended its Nurse Agency Licensing Act, creating certain prohibitions and/or new requirements.

- Entering into “covenants not to compete” with nurses and certified nurse aides (CNAs) that imposes restrictions on the employee’s ability to work for another employer or in a specified geographic area.

- Requiring payment of liquidated damages or other compensation if a provider hires an agency employee as a regular employee.

- Recruiting potential employees on provider premises.

- Requires an agency to submit new health care facility contracts with a full disclosure of the charges to a provider and compensation to agency employees, to the Illinois Department of Labor (IDOL) within five business days of the contract effective date.

- Agencies are now required to submit quarterly reports listing average amounts charged to providers, average amounts paid to agency employees, and average amount of labor-related costs. The amended law further requires the agency to pay wages to nurses and CNAs that match the wages listed in the agency contract submitted to IDOL or face penalties.

- Louisiana: Passed a law in August of 2022 requiring agencies to obtain a license from the state and pay a fee.

- The law prohibits agencies and providers from requiring agency employees to engage in recruitment efforts as a condition of employment in their contracts.

- The law prohibits nurse agencies from offering financial incentives to agency employees for recruiting permanent employees of providers to become agency employees.

- Agencies may only charge a fee for conversion of agency employees into permanent employees of the health care facility under certain conditions (i.e., payable by the provider, reduced pro-rata based on the length of time the agency employee provided services on behalf of the staffing agency, etc.).

- Oregon: Passed a law requiring agencies to register with the state and pay an annual fee. The new law requires agencies,

- Only charge fees to providers for hiring agency employees as permanent staff, and pay provider fees when the agency hires the provider’s staff members, if:

- The temporary staffing agency or provider directly solicit employment, and

- The contract between the agency and provider allows each party to charge or receive the fees described above. The law’s provisions are operative as of July 1, 2023.

- The law also requires the Oregon Health Authority to develop a process to set maximum rates that an agency may charge.

- Only charge fees to providers for hiring agency employees as permanent staff, and pay provider fees when the agency hires the provider’s staff members, if:

- Pennsylvania: Signed in November 2022, the bill contains many common features found in other comparable bills in other states.

- Requires agencies to register with the State.

- Requires agencies validate the health care credentials of contracted employees as well as the create policies and procedures for agencies to abide by, such as carrying medical malpractice insurance.

- The bill bans non-compete clauses in agency contracts.

Ohio has pending legislation (HB466) as of this post (date).