Over the years that I have authored this blog, a frequent theme or issue I am often asked to opine on is the connection between the residential real estate market and senior living sales. In June of this year, I did a post on this topic focusing on Life Plan sales and the residential real estate market Tough Housing Market = Life Plan Challenges – Reg’s Blog

As 2025 winds down (just a few days left) and 2026 is lurking, right around the corner, I thought now was a good time to take a “big cut” at where the real estate market is, what the outlook for 2026 is and once again, how the same connects to senior living sales.

Real Estate Snapshot

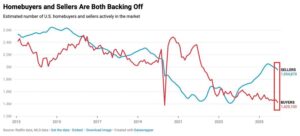

US homebuyers and sellers are both withdrawing from the market. In November, the estimated number of US homebuyers declined to 1,425,100—the second-lowest level in at least twelve years. For comparison, the pandemic low was 1,379,487 in April 2020. The number of buyers has trended downward since 2021. Similarly, sellers decreased to 1,954,870, marking the lowest point since February 2025 and reflecting a sixth consecutive monthly decline. Currently, there are 37.2% more home sellers than buyers, representing the fourth-highest monthly gap in at least twelve years; this compares to 36.6% in November 2021, near the previous market low. This imbalance underscores the ongoing slowdown in housing activity.

Current Real Estate Sales Activity

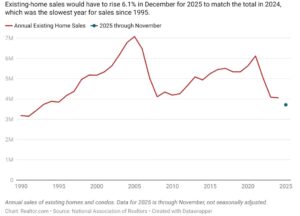

Pending home sales did increase in November as mortgage rates eased; however, this uptick will be insufficient to prevent 2025 from recording the lowest sales volume in thirty years. Signed contracts for existing homes rose 3.3% month-over-month, with all four regions registering gains, according to the National Association of Realtors® (NAR). Pending sales were up 2.6% year-over-year, representing the strongest month of 2025 after seasonal adjustments.

“This recent momentum reflects the combined effects of easing mortgage rates and gradually improving supply,” said Hannah Jones, Senior Economic Research Analyst at Realtor.com®. “Nevertheless, despite these favorable factors, overall housing market activity remains subdued among both buyers and sellers.”

Year-to-date through November 2025, home sales total 3.714 million, marginally below the same period in 2024. To match last year’s figure and avoid setting a new three-decade low, December sales would need to rise by 6.1% before seasonal adjustment. These figures suggest that affordability constraints and economic uncertainty continue to sideline many potential buyers, extending a trend of historically low home sales for the third consecutive year.

Affordability is beginning to improve incrementally as mortgage rates soften and wage growth outpaces increases in home prices, which is expected to drive higher home sales in 2026. NAR Chief Economist Lawrence Yun projects that existing home sales could rise by 14% next year, largely due to lower mortgage rates, while the Realtor.com research team anticipates a more modest increase of 1.7%.

Real Estate Sales Forecasts for 2026

| Metric | 2025 Estimate | 2026 Forecast Range | Consensus/Notes |

| Existing-Home Sales | ~4.0–4.1 million | 4.13–4.45 million (+2–14% YoY) | NAR most optimistic at +14%; Zillow/Redfin ~4.2–4.3M (+3–5%); Realtor.com ~4.13M (+2%) |

| Home Prices (Median) | +3–4% YoY growth | +1–4% YoY growth | NAR: +4%; Zillow/Redfin/Realtor.com: +1–2.2%; Some regional declines possible |

| Mortgage Rates (30-yr fixed avg.) | ~6.6–6.7% | 6.0–6.3% | NAR/Fannie Mae: ~6.0%; Redfin/MBA: 6.3%; Unlikely to drop below 6% sustainably |

| Inventory | Rising modestly | +10% or more | Continued growth expected, shifting toward buyer-friendly conditions |

2026 Housing Market Outlook Data Points

Sales Volume

Existing home sales, which constitute approximately 90% of all residential transactions, are demonstrating a measured recovery. Nonetheless, volumes persist at levels near a three-decade low, predominantly attributed to the “lock-in effect.” This phenomenon arises when homeowners are disinclined to sell, preferring to retain historically low mortgage rates.

Projections for 2026 from the National Association of Realtors (NAR) indicate a notable resurgence, with sales volume anticipated to increase by roughly 14%. This expected growth is supported by several factors, including the forecasted moderation of interest rates, continued employment expansion, and the anticipated increase in available inventory, all likely to facilitate renewed activity among previously sidelined buyers.

Alternative industry forecasts offer a more cautious outlook. Zillow projects a 5% increase, Redfin anticipates a 3% gain, and Realtor.com estimates growth in the vicinity of 2%. These estimates correspond to annual sales ranging from approximately 4.2 to 4.3 million units, reflecting persistent affordability challenges.

Sales of new homes are also expected to rise modestly, with forecasts suggesting an increase between 5% and 9%, bolstered by additional inventory provided by home builders. In aggregate, total home sales—including existing and new properties—are projected to approach 5 million units, a figure that remains below the robust annual average of more than 6 million homes transacted during peak market periods.

Home Prices

Home price appreciation is expected to remain moderate as demand strengthens, despite the continued constraints on supply. The NAR forecasts a price increase of approximately 4%, citing stable market fundamentals supported by low mortgage delinquency rates and substantial homeowner equity.

Other projections indicate slower growth; Zillow forecasts a 2% increase, Redfin anticipates 1%, and Realtor.com predicts a gain of 2.2%. When adjusted for inflation, the actual value of homes may remain stagnant or experience a slight decline should wage growth exceed property appreciation.

Regional variation is anticipated, with certain overbuilt Sun Belt markets—such as specific sectors of Florida and Texas—likely to experience price softening. Conversely, regions including the Northeast, Midwest, and various technology hubs may observe more robust price appreciation.

Mortgage Rates

Mortgage rates are expected to decrease modestly yet will likely remain above the historically low levels observed during the pandemic. The majority of analysts estimate 30-year fixed rates to be in the range of 6.0% to 6.3%, with Fannie Mae projecting a potential decrease to 5.9% by year-end.

Such conditions have the potential to expand the pool of eligible buyers by several million, as noted in NAR analyses. However, rates below 5% are not anticipated. The gradual improvement in housing affordability, as wage growth outpaces increases in home prices and inventory expands, will primarily benefit buyers; nonetheless, first-time purchasers are expected to continue facing considerable challenges.

Additional Market Trends and Considerations

- Inventory Growth: An increase in listings, generated by both new construction and returning sellers, is expected to provide advantages to buyers. This trend should enable greater negotiation opportunities and may result in more frequent seller concessions.

- Notable Markets: The NAR identifies Indianapolis, Jacksonville, and Spokane as markets with particularly strong sales prospects, attributable to favourable affordability and inventory dynamics.

- Risks: Potential risks to growth include economic slowdowns, persistent inflation, or shifts in policy. Nonetheless, a pronounced market downturn appears improbable, given the overall sound financial health of current homeowners.

In summary, the housing market in 2026 is expected to undergo a “reset,” distinguished by renewed activity without a reversion to the exceptional conditions of previous boom cycles. Buyers should benefit from increased selection and enhanced negotiating leverage, while sellers in many regions may anticipate continued price appreciation.

Residential Real Estate and Senior living

The residential real estate market significantly influences senior living sales—referring to leasing or selling units in senior living communities—which drives both occupancy and revenue. Many seniors rely on selling their primary residences to fund their transition, unlock equity for entrance fees or ongoing costs, or facilitate relocation. While precise correlation coefficients are rarely disclosed in industry reports, qualitative analyses from organizations such as the National Investment Center for Seniors Housing & Care (NIC) and senior living consultancies indicate a clear link: favorable housing conditions accelerate move-ins, while adverse environments cause delays.

Positive Impacts from Elevated Home Prices and Seller’s Markets

When home values are high, seniors can realize substantial profits from sales, providing the flexibility to pursue senior living options, including independent living, assisted living, or continuing care retirement communities. For example, in 2023, median resale values for single-family homes increased by 1.6% year-over-year to record highs, even amid rising mortgage rates—a seller’s market dynamic supported by tight inventory (2.9 months’ supply). This trend enabled most prospective senior living residents to access equity efficiently, especially in regions like the Northeast (+4.4%).

A 2024 report highlighted that, even as supply increased, annual resale rates remained stable, maintaining advantages for sellers such as seniors. As of mid-2025, this supportive environment has contributed to senior housing occupancy rising to 88.7% in Q3 2025, an increase of 0.7 percentage points quarter-over-quarter, with net absorption outpacing new supply at a ratio of 2.5:1.

Negative Impacts from Slow Sales or High Interest Rates

Conversely, sluggish housing markets can delay home sales, postponing seniors’ moves and dampening senior living sales velocity. In 2023, existing home resales fell 16% year-over-year amid mortgage rates reaching 7.05%, which lengthened listing times and reduced willingness to relocate. Additionally, the “lock-in effect”—where homeowners retain properties to preserve low-rate mortgages—has indirectly suppressed senior living demand. Regional differences amplify these impacts; for instance, the West experienced sales volume declines exceeding 45% in early 2023. Broader economic volatility, such as widening capital market spreads, has been partially mitigated by senior living rent growth of 3.9% annually in Q1 2025, though housing transaction delays remain a challenge.

The relationship is somewhat bifurcated. Seniors’ strong preference for aging in place (with estimates suggesting 75–95% of adults aged 50+ wish to remain in their homes) keeps significant inventory off the market, thereby tightening supply and supporting elevated prices, which benefits those who ultimately sell to fund senior living transitions.

According to housingmatters.urban.org, only about 17% of older homeowners opt to sell their homes during retirement, indicating that the housing market primarily affects a subset of seniors—often those aged 75 and above with sufficient home equity. High homeownership rates among seniors (for example, 81% for white seniors) closely link their mobility to real estate trends. Moreover, with over 70% of these homes built before 1990, sales are sometimes necessary to avoid maintenance burdens.

Interesting enough and not directly tied to the real estate focus of this article, Fitch Ratings released their 2026 outlook for CCRCS/ Life Plan Communities earlier this month. As in 2025, the outlook is “neutral”. In an upcoming post, I’ll take a deeper look at this slice of the senior living industry. The Fitch release is here: Fitch Maintains Neutral Outlook for U.S. Not-for-Profit Life Plan Communities in 2026; Demographic Tailwinds Offset by Higher Leverage