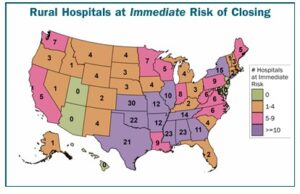

Seven hundred fifty-six rural hospitals in the United States are at risk of closure due to financial instability, with over 40% classified as being at immediate risk. These figures are derived from the Center for Healthcare Quality and Payment Reform’s latest analysis, which utilizes current cost reports submitted to CMS and verified through December 2025. The report distinguishes between two tiers of vulnerability: hospitals at risk of closure and those facing immediate risk. Rural_Hospitals_at_Risk_of_Closing (1)

On average, rural residents must travel twice as far—approximately 18 miles—to access medical care compared to their urban counterparts. With more than 700 rural hospitals at risk, including 300 at immediate risk, this distance is likely to increase, further impacting affected populations. Unlike urban communities, rural areas often depend on these facilities for both primary and emergency care; therefore, each hospital closure diminishes access to preventative and routine healthcare services. In February of last year, I wrote a similar article on the pressure rural healthcare was facing Rural Healthcare Under Intense Pressure – Reg’s Blog

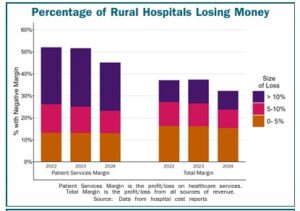

The predominant factor placing hundreds of rural hospitals at risk is inadequate reimbursement from private insurance plans, which often pay less than the actual cost of services provided. Medicare Advantage (MA) plans are included in this category. Historically, solutions have focused on increasing Medicare or Medicaid payments or expanding Medicaid eligibility, based on the misconception that most rural patients are covered by government programs or are uninsured. In reality, roughly half of all services provided at the average rural hospital are for patients with private insurance, including employer-sponsored and MA plans. Consequently, the payment rates set by private insurers more frequently determine a rural hospital’s financial viability.

Challenges Posed by Medicare Advantage

Medicare Advantage presents a complex, increasingly challenging environment for rural hospitals. While some studies indicate higher MA penetration might correlate with improved margins due to hospital characteristics, the American Hospital Association (The Growing Impact of Medicare Advantage on Rural Hospitals Across America | AHA ) and other experts emphasize the pressures stemming from lower MA reimbursements, administrative burdens such as prior authorization, delayed payments, and narrow networks. These challenges contribute to financial difficulties even when some analyses identify neutral effects.

- Lower Reimbursement: MA plans frequently reimburse at lower rates than traditional Medicare, reducing revenue for hospitals reliant on Medicare income.

- Administrative Burden: Strict utilization management policies add to operating costs and cause delays, particularly problematic for hospitals with limited staff.

- Payment Delays/Denials: Payment denials and delays strain the cash flow of rural facilities.

- Narrow Networks: Exclusion from MA networks can divert patient volume and revenue away from rural hospitals.

- Increasing MA Market Share: A growing proportion of Medicare revenue for rural hospitals now comes from MA, heightening exposure to these challenges.

Reasons for Closures

Multiple factors contribute to the ongoing wave of rural hospital closures, including declining patient volumes, low reimbursement rates from both public and private payers, staffing shortages, alternative care models, and additional operational challenges. Professor Alan Sager, an expert in health law, policy, and management, notes that accountability is lacking among governmental bodies and private insurers for addressing issues related to hospital need, capacity, service provision, and financial sustainability. No entity currently bears responsibility for ensuring adequate healthcare infrastructure and revenue to support necessary care delivery.

Despite this lack of accountability, Sager contends that affordable and accessible healthcare is achievable nationwide, citing the nation’s considerable healthcare expenditure—estimated at $5.6 trillion annually. He asserts that reform could be realized by curbing wasteful spending and ensuring adequate compensation for healthcare providers. Sager’s book, The Easiest, outlines a comprehensive plan for reform, noting that the U.S. spends significantly more per capita than other developed nations but achieves poorer outcomes.

All States have Closure Risk

Nearly every state has hospitals at risk of closure, with these facilities possessing financial reserves sufficient to cover losses for only six to seven years. In over half of all states, at least 25% of rural hospitals face this risk, and in ten states, 50% or more are jeopardized. Additionally, the report (see first paragraph) identifies 323 rural hospitals at immediate risk—meaning their financial reserves can sustain operations for no more than two to three years—a figure that has increased slightly in recent months.

Below is a state-by-state listing of the number of rural hospitals at risk of closure in the next six to seven years and at immediate risk of closure over the next two to three years.

Alabama

28 hospitals at risk of closing (58%)

23 at immediate risk of closing in next 2-3 years (48%)

Alaska

3 hospitals at risk of closing (19%)

1 at immediate risk of closing in next 2-3 years (6%)

Arizona

4 hospitals at risk of closing (15%)

0 at immediate risk of closing in next 2-3 years (0%)

Arkansas

30 hospitals at risk of closing (64%)

12 at immediate risk of closing in next 2-3 years (26%)

California

18 hospitals at risk of closing (31%)

5 at immediate risk of closing in next 2-3 years (8%)

Colorado

11 hospitals at risk of closing (26%)

2 at immediate risk of closing in next 2-3 years (5%)

Connecticut

3 hospitals at risk of closing (75%)

2 at immediate risk of closing in next 2-3 years (50%)

Delaware

0 hospitals at risk of closing

0 at immediate risk of closing in next 2-3 years

Florida

8 hospitals at risk of closing (36%)

2 at immediate risk of closing in next 2-3 years (9%)

Georgia

22 hospitals at risk of closing (30%)

11 at immediate risk of closing in next 2-3 years (15%)

Hawaii

8 hospitals at risk of closing (62%)

0 at immediate risk of closing in next 2-3 years

Idaho

9 hospitals at risk of closing (33%)

1 at immediate risk of closing in next 2-3 years (4%)

Illinois

17 hospitals at risk of closing (22%)

10 at immediate risk of closing in next 2-3 years (13%)

Indiana

9 hospitals at risk of closing (16%)

8 at immediate risk of closing in next 2-3 years (15%)

Iowa

19 hospitals at risk of closing (20%)

4 at immediate risk of closing in next 2-3 years (4%)

Kansas

68 hospitals at risk of closing (68%)

30 at immediate risk of closing in next 2-3 years (30%)

Kentucky

17 hospitals at risk of closing (25%)

2 at immediate risk of closing in next 2-3 years (3%)

Louisiana

27 hospitals at risk of closing (48%)

9 at immediate risk of closing in next 2-3 years (16%)

Maine

11 hospitals at risk of closing (46%)

5 at immediate risk of closing in next 2-3 years (21%)

Maryland

0 hospitals at risk of closing

0 at immediate risk of closing in next 2-3 years

Massachusetts

2 hospitals at risk of closing (29%)

1 at immediate risk of closing in next 2-3 years (14%)

Michigan

10 hospitals at risk of closing (15%)

4 at immediate risk of closing in next 2-3 years (6%)

Minnesota

18 hospitals at risk of closing (19%)

7 at immediate risk of closing in next 2-3 years (7%)

Mississippi

36 hospitals at risk of closing (54%)

23 at immediate risk of closing in next 2-3 years (34%)

Missouri

29 hospitals at risk of closing (50%)

12 at immediate risk of closing in next 2-3 years (21%)

Montana

16 hospitals at risk of closing (30%)

4 at immediate risk of closing in next 2-3 years (8%)

Nebraska

7 hospitals at risk of closing (10%)

3 at immediate risk of closing in next 2-3 years (4%)

Nevada

5 hospitals at risk of closing (36%)

1 at immediate risk of closing in next 2-3 years (7%)

New Hampshire

4 hospitals at risk of closing (22%)

3 at immediate risk of closing in next 2-3 years (17%)

New Jersey

0 hospitals at risk of closing

0 at immediate risk of closing in next 2-3 years

New Mexico

8 hospitals at risk of closing (30%)

4 at immediate risk of closing in next 2-3 years (15%)

New York

24 hospitals at risk of closing (48%)

15 at immediate risk of closing in next 2-3 years (30%)

North Carolina

10 hospitals at risk of closing (18%)

6 at immediate risk of closing in next 2-3 years (11%)

North Dakota

13 hospitals at risk of closing (34%)

4 at immediate risk of closing in next 2-3 years (11%)

Ohio

7 hospitals at risk of closing (9%)

3 at immediate risk of closing in next 2-3 years (4%)

Oklahoma

48 hospitals at risk of closing (64%)

22 at immediate risk of closing in next 2-3 years (29%)

Oregon

7 hospitals at risk of closing (21%)

3 at immediate risk of closing in next 2-3 years (9%)

Pennsylvania

17 hospitals at risk of closing (33%)

9 at immediate risk of closing in next 2-3 years (17%)

Rhode Island

1 hospital at risk of closing (100%)

1 at immediate risk of closing in next 2-3 years (100%)

South Carolina

7 hospitals at risk of closing (32%)

4 at immediate risk of closing in next 2-3 years (18%)

South Dakota

9 hospitals at risk of closing (19%)

3 at immediate risk of closing in next 2-3 years (6%)

Tennessee

16 hospitals at risk of closing (31%)

14 at immediate risk of closing in next 2-3 years (27%)

Texas

82 hospitals at risk of closing (53%)

21 at immediate risk of closing in next 2-3 years (14%)

Utah

0 hospitals at risk of closing

0 at immediate risk of closing in next 2-3 years

Virginia

9 hospitals at risk of closing (29%)

6 at immediate risk of closing in next 2-3 years (19%)

Washington

19 hospitals at risk of closing (42%)

7 at immediate risk of closing in next 2-3 years (16%)

West Virginia

15 hospitals at risk of closing (44%)

6 at immediate risk of closing in next 2-3 years (18%)

Wisconsin

10 hospitals at risk of closing (12%)

5 at immediate risk of closing in next 2-3 years (6%)

Wyoming

7 hospitals at risk of closing (26%)

4 at immediate risk of closing in next 2-3 years (15%)