Over the years, I have written and spoken on the direct connection that Life Plan/CCRC organizations have with the residential real estate market. This is particularly true for entry fee Life Plan communities (CCRCs). https://rhislop3.com/real-estate-sales-report-news-worsens-for-ccrcs-life-plan-communities/

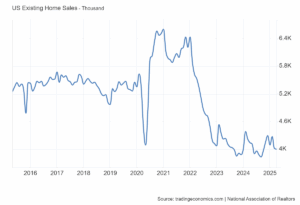

Today and across the recent six to nine months, the residential real estate market has been as illiquid (reduced sales) as I have seen since the credit and real estate crunch of the late 2000s and early 2010s.

- In May, Existing home sales in the US declined 0.5% m-o-m to a seasonally adjusted rate of 4.00 million in April 2025, the lowest in seven months, compared to 4.020 million in March and forecasts of 4.1 million, restrained by high mortgage rates. Sales dipped in the Northeast (-2%) and West (-3.9%), grew in the Midwest (2.1%) and were unchanged in the South. The total housing inventory was 1.45 million units, up 9% from March. The median existing home price for all housing types was $414,000, up 1.8% from one year ago. “Home sales have been at 75% of normal or pre-pandemic activity for the past 3 years, even with 7 million jobs added to the economy. Pent-up housing demand continues to grow, though not realized (National Association of Realtors). More current data here: currenthvspress.pdf

- In 2024, around 31% of single-family homes in the U.S. are owned by people aged 65 and older. This estimate is based on the fact that about 79% of those over 65 own homes, with 86.1% of these being single-family residences.

With this much constriction in sale volume, the impact for a CCRC needing to generate new sales with new entry fees, often to collateralize refunds, can be painful and in some cases, challenging. The picture now, is follows.

Reduced Move-Ins

- Home Sale Dependency: Many seniors planning to move into a CCRC rely on selling their current homes to afford entrance fees and ongoing monthly costs.

- Market Slowdown: A slow real estate market can delay or complicate the sale of homes, potentially postponing or preventing seniors from moving into a CCRC.

- Impact on Occupancy: Reduced move-ins can affect a CCRC’s occupancy rates, which in turn can impact their financial stability and operational efficiency. Unfortunately, too many facilities today have turned to incentives (rent abatement, rent reduction, entrance fee financing, etc.) to garner sales. Too much reliance on incentives dilutes brand value and can, negatively impact financial performance.

- Financial Strain: Communities often use the revenue from entry fee sales for various operating and capital purposes and as an element (if debt is applicable) of covenant compliance.

- Lower Entrance Fees: A prolonged slowdown in occupancy may lead CCRCs to adjust their pricing or entrance fee structure, which could reduce revenue. This could also be problematic if a unit awaiting resale has a higher refund due to the prior resident than a new entry fee (if reduced for sales purposes) can collateralize.

- Refundable Entrance Fees: CCRCs offering refundable entrance fees might face financial challenges if reselling vacated units becomes difficult due to a real estate market downturn.

- Operational Costs: Maintaining facilities and services with lower occupancy rates can put strain on finances, especially if fixed operational costs remain constant.

Potential Impact on CCRC Operations & Development

- Reduced Revenue: Slower move-ins and potential price adjustments can lead to reduced revenue for CCRCs.

- Development Delays: The ability to finance and proceed with expansions or new developments can be impacted by slower occupancy and financial constraints.

Important Considerations

- Regional Variations: The impact of real estate market slowdowns can vary regionally, depending on local housing market conditions and specific factors related to each CCRC. Real estate conditions (sales, mortgage rates, demand and supply) are local and in some cases regional issues. Factors for example, that impact a Chicago market will be quite different than factors that impact the market in Oklahoma City.

- CCRC Financial Strength: Well-established and financially stable CCRCs might be better equipped to handle fluctuations in the real estate market compared to newer or less financially robust communities.

- Types of Contracts and Refunds: The financial impact can differ based on whether a CCRC offers refundable or non-refundable entrance fees, or other contract variations.

In summary, while the senior living industry is generally considered resilient, a slow real estate market can challenge CCRCs by potentially impacting occupancy, revenue, and financial stability, as many seniors depend on home sales to facilitate their move. Addressing the real estate conditions that may be adversely impacting an organization’s occupancy and marketing requires strategic planning and coordinated efforts across the organization, top down, to make an impact but in so doing, not create collateral damage. More in my next post.