Long title for a Tuesday. Two reports dropped within the last couple of days and into my email regarding CCRCs/ Life Plan communities and some interesting trends/outlooks.

Yesterday (Dec 4), Fitch issued its 2024 outlook for Life Plan/CCRCs, reaffirming its 2023 outlook as “deteriorating”. The primary reason for the gloomy outlook is present and projected, economic conditions including high (higher than recent) credit/capital costs, continued capital access constraints (banks tightening lending standards, LTVs, etc.), sticky high commodity costs (food, energy), and staffing challenges pushing wages upward and leaving positions unfilled or reliant on contract labor (lower productivity, higher cost). The press release is here: https://www.fitchratings.com/research/us-public-finance/us-life-plan-communities-to-navigate-high-tide-of-inflation-in-2024-04-12-2023

Another headwind that can be a significant problem for CCRCs/Life Plan communities is the stagnant residential real estate market and potentially now, housing price devaluation (though we haven’t seen this yet). If as is presently the case, the residential real estate market remains fundamentally illiquid, home sales that beget proceeds from entry fees, and thus move-ins, become a major obstacle for seniors. The majority of transitions into CCRCs/Life Plan communities where an entry fee is required, occur as a result of a primary residency sale and then, the use of the net proceeds (by the resident) from the sale as the source of funds for the entry fee. When sales are “stuck” as they are now, two things occur next. First, if credit conditions don’t improve creating more buyers (lower mortgage rates), sales remain slow or stagnate even more if rates move higher. Second, prices will need to come down to create more affordability for buyers. From the report: “However, occupancy and demand could soften if rate increases continue above historical norms or if cost-cutting erodes service quality. Decelerating growth in real estate pricing may also slow the current strong pace of independent living unit (ILU) sales and limit an LPC’s ability to raise entrance fees to absorb cost inflation and pay refunds”.

A reference post I wrote in September covers the economic outlook and Fitch a bit more in-depth. That post is here: https://rhislop3.com/2023/09/21/fitch-life-plan-ccrcs-and-the-economy-could-get-uglier/

A second report, a white paper, from Bild & Co. (senior living marketing and sales consultancy) provides insight on Q3 rate concessions and related tactics in senior housing, as a strategy to increase occupancy. The white paper is here: 11.30.23 Bild Market Surveys Q3-23 Concessions Analysis TB

The most common discounts communities were offering in the third quarter were reduced or discounted rent, waived or reduced community fees, or veterans/signature club discounts, according to the white paper. While some communities waived or reduced entrance fees, the use of rent abatement or reduced rent is on the rise. Typical reductions are for three months but some communities will take a longer approach, up to 12 months.

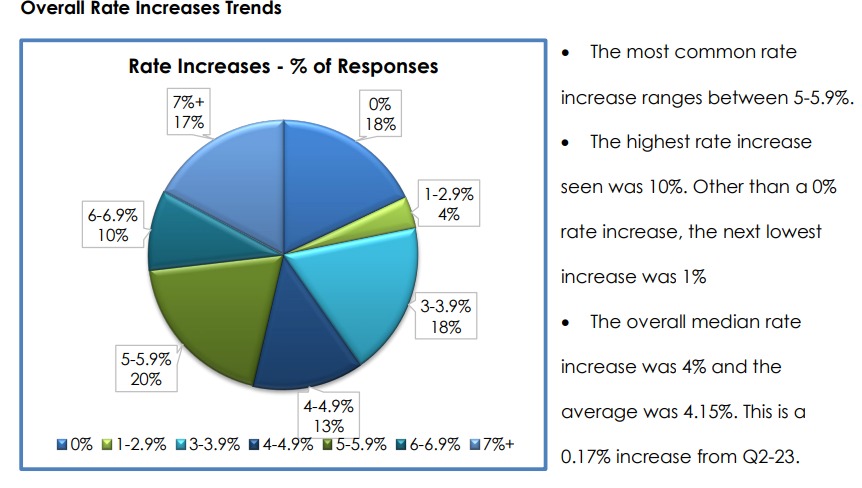

Rate increases continue to be higher than current CPI, running between 5% and 6% on average. Some increases have been as high at 10% (not common). The median increase is 4%.

The concern I have around rate reductions is that communities can quickly undermine their product and value proposition, especially with existing residents. I have been in communities/organizations that had run so many specials over time to gain occupancy that any form of rate integrity was long gone. This can be a significant problem in terms of debt covenants and/or revenue models and borrowing. It also can be devilish to correct, necessitating unpopular rent acceleration programs to homogenize the rent roll.

The real key for each community in terms of occupancy is building a value proposition that meets market expectations. Rates in terms of rent, are fundamentally a function of Fixed Costs + Variable Costs + Margin = Rental Rate. The proper methodology is to use this formula and apply it per square foot for each unit such that rate integrity is consistent across each unit type (2-bedrooms pay more than 1-bedroom units, etc.). On the Presentations page of this site, there are two Power Points from presentations I did that cover this topic in detail – Value Propositions and Marketing and the Intersection of Pricing and Marketing. Both are free for download.

I am not opposed to using incentives, but I urge communities to utilize a strategic approach that enhances or creates value consistent with the organization’s value proposition. For example, instead of reducing rents, hold the next year’s rent increase for a period of time, at which time in the future, it moves up to the current schedule. Add value by paying for moving, adding an organizer and moving consultant for the resident (so many hours, free), provide unit upgrades at no cost (to a point). Fundamentally, rent should be pure, a function of proper pricing and a proper revenue model.