Introduction

Meredith Whitney, often referred to as the Oracle of Wall Street, has made a startling reversal in her long-held predictions about the housing market. For years, her theory of a “silver tsunami” posited that an influx of older homeowners would flood the market with listings, driving property values down and creating opportunities for younger buyers to purchase homes at lower prices. Recently, however, she has revised her outlook based on new data, leading to a significant shift in her expectations. 3 Top Predictions for Economy, Housing in 2025: Meredith Whitney – Business Insider

The Original “Silver Tsunami” Theory

Whitney’s original theory was predicated on the assumption that as the US population aged, older homeowners would move out of their long-term residences and into more suitable living arrangements such as ranch-style homes, retirement communities, or nursing homes. This mass exodus was expected to increase the supply of homes on the market, thereby reducing prices and providing a golden opportunity for younger generations to enter the housing market.

Expectations of Market Impact

The anticipated impact of this “silver tsunami” was significant. With a sudden increase in home listings, property values were expected to decrease noticeably. This would ostensibly solve the affordability crisis that has plagued many younger buyers, particularly Millennials and Gen-Zers, who have struggled to purchase homes in an increasingly competitive market.

Revisiting the Data

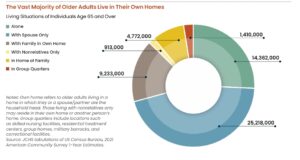

Various recent analyses, however, has led her to reconsider this theory. Digging deeper into current trends and data, she found that the reality is more complex than she initially thought. Despite the aging population, older homeowners are not moving out of their homes en masse. Instead, a trend of “aging in place” has emerged, wherein seniors prefer to stay in their current homes as long as possible.

Factors Influencing the Change

One of the critical factors contributing to this shift is the cost associated with moving to alternative housing. Retirement communities and nursing homes can be prohibitively expensive, limiting the options for many seniors. According to a 2023 Harvard study on housing older adults in the US, only about one in eight seniors can afford assisted living without tapping into their assets. This financial barrier has led many to opt for aging in place instead. Harvard_JCHS_Housing_Americas_Older_Adults_2023

While ongoing demand for senior living and housing remains strong, and a lack of new inventory has bolstered occupancy, the trend may be less favorable as real estate market conditions remain generally unfavorable for sales (higher interest rates, higher prices, tighter lending conditions), except at discounted levels. An article I wrote in 2023 is still relevant: https://rhislop3.com/senior-housing-and-the-real-estate-market-status/

Adjustments and Home Renovations

Rather than moving, many older homeowners are choosing to modify their existing homes to better accommodate their needs as they age. Whitney noted that seniors are increasingly taking out lines of credit to finance home renovations. These modifications often include adding ground-floor bedrooms, installing walk-in tubs, or even setting up movable stair systems to facilitate easier mobility within their homes.

Implications for the Housing Market

This trend has significant implications for the housing market. If older homeowners choose to stay put, the expected influx of available homes for younger buyers will not materialize. This could further strain an already tight housing market, where inventory is limited, and demand remains high.

Sales did modestly creep up toward year-end, though the volume remains considerably below pre-pandemic levels. This level of illiquidity does not bode well for a senior “needing” to liquidate a residence as a primary condition of moving to senior housing, especially if selling requires price concessions. ehs-12-2024-summary-2025-01-24

New Home Construction as a Solution

Despite these challenges, Whitney remains optimistic about the future for younger homebuyers. She points out that new home inventory is on the rise, which could provide a critical lifeline for those looking to enter the housing market. “Their best chance of owning a home is with new homes — not existing,” Whitney said, emphasizing that the growth in new home construction could offset the lack of existing homes entering the market. If she is correct and this is the trend required for younger buyers to participate in the housing market, this bodes poorly for seniors needing to sell and existing home.

Market Dynamics for Millennials and Gen-Zers

While Millennials and Gen-Zers might not experience the housing market shift that Whitney initially predicted, they are not entirely out of options. The increase in new home construction offers a viable path to homeownership. Although this solution might not provide the steep discounts once anticipated, it does present an opportunity for younger buyers to find homes in an otherwise challenging market.

Conclusion

Whitney’s change in perspective underscores the complexity of the housing market and the factors that influence it. The expectation of a “silver tsunami” giving way to a trend of aging in place highlights the need for continuous data analysis and market adaptation. As the housing market evolves, so too must the strategies of those looking to navigate it. While her original theory may no longer hold, her revised outlook offers insight for senior living/housing providers that can create a solid value proposition that is affordable within the new market/valuation reality. Similarly, supporting a growing cohort that chooses to remain in the community could be a value-add proposition generating significant new business and new revenue.

The housing market remains a dynamic and multifaceted landscape, shaped by demographic changes, economic factors, and individual choices. The ability to adapt to predictions based on new data serves as a reminder of the importance of flexibility and informed decision-making in an ever-changing world. As older homeowners choose to stay put and new construction rises, the path to homeownership may look different than initially expected, but opportunities still abound for those willing to seize them. One such example is to look at market rate and modest income housing – a product that is in high demand nationwide.